Yasmine Motarjemi, ancien cadre responsable pour la sécurité alimentaire chez Nestlé, est engagée ces temps dans un procès contre son ex-employeur pour harcèlement psychologique. Dans un texte, dont je retranscris ici des extraits, elle fait part de ses réflexions suscitées par son expérience.

Bernard Walter

Bernard Walter

Je souhaite en préambule soulever trois points concernant la justice et son importance.

a) L'importance de la justice pour la société

Un système judiciaire performant est pour moi aussi essentiel que le système de santé. C'est un des piliers de notre civilisation et des droits de l’homme. Car la paix dans notre cœur et notre esprit passe par la justice. Et inversement, l'injustice crée de la souffrance et mène à la violence. Le but de la justice est de réparer le tort fait aux victimes, mais également de punir les personnes coupables de délits pour éviter leurs répétitions et prévenir les récidives. D'où l'importance d'un bon fonctionnement de la justice.Une injustice faite à un seul

est une menace faite à tous.

Montesquieu

De plus, si la justice ne fonctionne pas bien, c'est un encouragement pour les malfaiteurs qui voient l’impunité de leurs pratiques. En d’autres termes, un système judiciaire efficace est un moyen de dissuasion. Prenons l'exemple du harcèlement moral en milieu professionnel. Ce phénomène a été longtemps largement ignoré et il semble s'être pour cette raison intégré à la culture de certaines entreprises comme un style de management. Cela va jusqu'au point où les employés eux-mêmes s'en accommodent et le considèrent comme «normal». Lorsque de telles pratiques de harcèlement deviennent une norme de société, on parle, comme l'expert français Christophe Dejours, de «banalisation du mal». Alors il devient très difficile de s'y opposer, et de le dénoncer; c'est l'expérience que je traverse depuis plusieurs années.est une menace faite à tous.

Montesquieu

b) La justice pour les victimes

L'expérience d’une injustice grave crée chez la victime colère, frustration et mal-être. Dans les cas de harcèlement psychologique, la douleur est indescriptible. Hélas, cette douleur est invisible aux yeux des autres et la victime reste seule et isolée avec son mal.Les victimes de telles injustices ont trois options:

- Ne rien faire. Dans ce cas, la colère et le sentiment d’injustice peuvent profondément affecter leur santé et leur bien-être.

- Ou bien exprimer leur colère, ce qui risque de provoquer des actes de violence, soit contre les personnes perçues comme leurs bourreaux, soit contre elles-mêmes si moralement elles ne se voient pas capables d'exercer une violence sur autrui.

- Ou enfin résister pacifiquement et avoir recours à la justice. C’est la voie que j’ai choisie, tout d'abord en utilisant les voies de service de mon ancien employeur, Nestlé, puis en portant mon affaire devant la justice du pays. Cela m'a coûté très cher: je le paie de ma carrière, de ma santé, de mes économies et de ma réputation. Le plus grave est l’impact sur ma famille et mes relations sociales. En plus je cours le risque de subir l’injustice de la justice.

Il n’y a point de plus cruelle tyrannie que celle que l’on exerce à l’ombre des lois et avec les couleurs de la justice.

Montesquieu

Montesquieu

c) L’éthique dans l’exercice de la justice

Toute personne, victime ou malfaiteur, a droit à être défendue et a droit à un procès équitable. Dans l'idéal, le système judiciaire devrait chercher et défendre la vérité en toute circonstance, depuis le début de la procédure jusqu'au jugement final. Il devrait en aller de même pour l'avocat d'un accusé. Tout en défendant les droits de son client, l'avocat ne devrait pas l'aider à couvrir ses agissements délictueux.Le progrès humain n’est ni automatique ni inévitable… Chaque pas vers l'objectif de la justice exige le sacrifice, la souffrance et la lutte ainsi que les efforts inlassables et le souci passionné d'individus dédiés.

Dr Martin Luther King, Jr.

Dr Martin Luther King, Jr.

Les problèmes qui se posent aux victimes

- Le plus souvent, ce n'est qu'au moment où les victimes sont réellement confrontées à de graves difficultés qu'elles commencent à prendre conscience qu'elles ont des droits et qu'il est important que ces droits, elles les connaissent. Par exemple, dans le cadre de son travail, chacun devrait avoir droit à un cahier des charges définissant la nature de son travail et les limites de ses responsabilités. Dans mon cas, chez Nestlé, une entreprise d'une telle importance, les choses se sont passées de façon ad hoc et aléatoire, sans que jamais j'aie su sur quelles bases le système fonctionnait réellement. De même, c’est dans la difficulté que les citoyens commencent à s’intéresser au fonctionnement du système judiciaire.

- Une fois que le litige s'est révélé ouvertement, il se pose la question du choix de son avocat. Pour tout citoyen, le choix est déjà difficile; mais, face à une multinationale de l'importance de Nestlé, ce n'est pas une mince affaire: peu d'avocats sont prêts à affronter le risque d'un rapport de force par trop inégal.

- Ensuite, il y a le problème des coûts et de toutes les intrigues procédurières qu'il va falloir affronter. Outre les moyens énormes qu'il faut investir, ce qui n'est pas toujours possible, c'est un vrai parcours du combattant que la victime va devoir traverser. A part les preuves, un procès civil demande en effet à la victime un investissement colossal en temps et en énergie alors qu’elle se trouve déjà moralement fragilisée et en souffrance. Il me paraît finalement très injuste qu'en tant que victime je doive payer une somme faramineuse pour obtenir la justice, alors qu’aux criminels on octroie un avocat d’office et ils ont droit à des procès à la charge de la société. Je ressens cette situation d’autant plus injuste que je porte plainte, en grande partie, pour alerter la société sur les mauvaises pratiques de mon ex-employeur.

- Ce qui est très difficile dans un procès tel que le mien, c'est la très longue durée de la procédure. Ce qui veut dire que le temps des souffrances s'allonge et que tant que le procès est en cours, on ne peut pas penser à reconstruire sa vie et reprendre la vie professionnelle.

Pour conclure

Ce ne sont là que les points principaux liés à mon expérience que j'ai soulevés. Les problèmes que j'ai eu à affronter sont multiples. Je n’ai même pas touché le rôle des médias, leur éthique dans la façon dont ils relatent les faits et la perception qu’ils donnent au public.La justice sans la force est impuissante; la force sans la justice est tyrannique.

Blaise Pascal

Si l'on pose toute cette problématique sur un plan très général, on peut bien voir qu'un tel parcours soulève des points de principe cruciaux quant à l'exercice de la justice. Il y a d'un côté les grandes questions de principe. Les lois existent, la justice est représentée avec les yeux bandés, ce qui montre bien son absolue impartialité, le système peut paraître parfait. Et de l'autre côté, il y a la vie, son pragmatisme et ses réalités. Il y a la réalité du rapport de force social, et toutes les réalités humaines qui sous-tendent ce rapport de force. Et, dans un tel contexte, l'individu qui va seul au combat se sent petit.Blaise Pascal

© Journal L'Essor 1905-2015 | Reproduction autorisée avec mention de la source et annonce à la Rédaction |

Avocat et expert parjures et juges complices ?

Politiques aveugles, muets, sourds, fraudes démocratiques facilitées par le système, faux sceaux, enveloppes translucides, nombreuses tricheries prouvées, comme en Autriche, Floride...

François de Siebenthal

Politiques aveugles, muets, sourds, fraudes démocratiques facilitées par le système, faux sceaux, enveloppes translucides, nombreuses tricheries prouvées, comme en Autriche, Floride...

François de Siebenthal

23, av. Dapples

1006 LAUSANNE

021 616 88 88

Monsieur le Juge de Paix de Lausanne,

Côtes de Montbenon 8

1014 LAUSANNE

Lausanne, le 04.07.2016. Votre référence : KC16.023321/GIN/bct

Monsieur le Juge de Paix de Lausanne,

Suite à votre dernière demande du 28 juin ct d’un dossier plus court, le voici en résumé où je vous prie d’établir la justice me concernant. La plupart des faits cités demandent une action automatique de la justice vaudoise, des poursuites d’office pour chercher la vérité et établir le droit et la justice. Plusieurs personnes mentent, ce qui DOIT AUSSI ÊTRE POURSUIVI D’OFFICE D’AUTANT PLUS QUE LES PREUVES SONT évidentes, NOTAMMENT POUR LES FRAUDES Électorales comme en Autriche. Les plaintes et procédures contre moi sont le fruit du lynchage médiatique, alors que j'ai essayé de participer à des élections démocratiques. Ces agressions visent la famille de Siebenthal depuis des années.

Je vous prie de tenir compte de l’entier des circonstances citées ci-dessous, et notamment mon combat pour les familles et une démographie positive. Je ne suis pas le seul à être berné par des structures de type mafieuses. Les Vaudois(es) sont leurrés et bernés – Pourquoi faut-il réagir ?

A. Des programmes informatiques sont, de manière voulue, des sources de problèmes et de factures au détriment notamment des contribuables pour des sommes en millions de francs.http://desiebenthal.blogspot.ch/2010/10/debacles-informatiques-par-milliards-en.html

B. Plus de FR 500'000.- sont subtilisés d’un compte bancaire par la justice…

C. Plus personne n’ignore l’affaire du diplomate iranien Naghy Gashtikhah, dont les droits ont été bafoués par les autorités judiciaires du Canton. Il est utile de rappeler que les Banques (Anker, BCGE) lui ont volé plus de 3 millions de Fr. Condamné par erreur à la prison, il a été relaxé après 18 mois sans excuses et sans dédommagement et la justice le charge maintenant à des frais de justice pour un montant total qui atteint les FR 300'000.-.

D. Il y a eu des tricheries sur les résultats des élections et des votations, comme en Autriche..

E. Beaucoup d’argent a été découvert suite à mes recherches notamment dans les caves des villas de la famille Georg Brozicek-Müller, notamment sur les comptes de la société Fefdoce, à Genève et surtout à Prague et je devais être rémunéré sur ces découvertes. J’ai eu aussi beaucoup de travail pour remplir les déclarations fiscales en souffrance et fermer toutes les sociétés concernées sans être dûment payé.

F. La veuve Georg Brozicek-Müller s’est arrangée avec les assurances et les banques suisses sans me tenir au courant, ce qui violait nos accords.

G. La famille Brocizek Müller a notamment abusé de toutes les institutions et personnes suisses impliquées, notamment de l’AI, des impôts, des assurances. Il travaillait à plus de 100 % en Tchéquie, alors qu’il recevait une rente complète AI en Suisse.

H. Les notaires et avocats impliqués cachent beaucoup de faits et il est impossible de récupérer le dossier complet qui m’a été repris avec de fausses promesses.

Je vous signale aussi parmi mes débiteurs notamment l'Etat de Vaud et des "hommes de loi" et leurs clients notamment à Genève. Je vous demande donc que :

1. me soient attribués les 500'000 fr donnés publiquement par M. Gashtikhah pour ma campagne politique et qui sont toujours sous un séquestre totalement injustifié encore ce jour.

2. nous soient attribués, à mes frères, à moi-même et à ma sœur, les droits de copyright sur les livres de notre père, notamment l'école globale et intégrée, photocopié indûment par l'État de Vaud, notamment par le séminaire pédagogique, et jamais honoré pendant plus de 30 ans de copies, soient attribués à ma famille. Ce vol de copyright est aussi à situer dans le cadre plus large de la mort de mes deux parents.

3. me soient attribués mes droits sur les brevets et fonds Ferraye, volés.

4. me soient attribuées les commissions qui me sont dues sur les fonds Brozicek-Ferraye, trouvés notamment sur les comptes de la Banque Leu à Genève et transférés à Prague, et trouvés aussi notamment dans la société Fefdoce, dont l'accès m'a été abruptement interdit par la veuve et ses hommes de "loi"à Prague et à Genève.

5. me soient attribués les dommages qui me sont dus suite à l'affaire du métro de Manille et aux tricheries, chantages et menaces d'employés de Baker & McKenzie de Hong-Kong et de Chicago ( not. de Mlle Christine Lagarde, qui a été présidente du comité stratégique mondial de Baker & McKenzie et actuellement présidente du FMI ) ainsi que de Mlle Fiona Loughfrey, Mark Lockwood, divers avocats et finalement MM. Joseph Estrada ancien Président des Philippines, qui a été condamné par la justice locale et M. Elie Eliahu Levin.

De graves erreurs d’enquête sont couvertes, voire ordonnées par le « juge » socialiste Creux qui a tout contrôlé de A à Z, y compris l’enquête financière et fiscale ( 12 ans de pièces...) de type policière, et l’« expert » cité plus haut. C'est un véritable procès politique de type stalinien pour lui faire payer ses positions en faveur de la vie et de la famille, avec un notaire qui persiste dans ce genre de persécution, alors qu’il a violé la bonne foi et l’engagement signé dans la convention qu'il a prise

Je demande donc la suppression pure et simple de cette pseudo dette ou l’ouverture d’un procès complet avec l’aide d’un avocat et le paiement des sommes qui me sont dues.

Mais la justice vaudoise cherche-t-elle vraiment la vérité ? Un Jugement neuchâtelois par exemple reconnaît que l'interdiction de témoigner dans le Canton de Vaud est une atteinte à la personnalité et à la vérité. http://www.viplift.org/f/info/enquete090210.html

Vous pourrez trouver plus d’éléments sur le site http://guillaume-tell.blogspot.ch/2016/07/persecutions-vaudoises-lettre-raccourcie.html Vous pourriez recevoir cette lettre par électronique pour vous en faciliter la lecture en m’envoyant votre adresse électronique à siebenthal@gmail.com

En vous priant d’établir la justice me concernant, je vous présente mes salutations les plus respectueuses

Annexes 1 à 14

Je m'adresse à vous donc en tant que détenteur d'une autorité publique et vous prie de prendre note de tous les faits et de les faire suivre à qui de droit. J'attire votre attention sur le fait que je ne suis pas avocat et que si la teneur de cette demande n'est pas conforme aux procédures judiciaires, il y a lieu de tenir compte de la jurisprudence suisse en la matière : Le destinataire d'un acte doit interpréter la portée de celui-ci d'après le sens qu'il «pouvait raisonnablement lui attribuer en le considérant comme réellement voulu, sur la base de l'attitude antérieure du déclarant et des circonstances qu'il connaissait au moment où la déclaration lui a été faite (ATF 94 II101, pp. 104-105, JT 1969 I 27, P. 28, cité par Engel, Traité des obligations en droit suisse 2è éd. 1997, pp. 238-239). Une déclaration adressée à une autorité doit être comprise selon le sens que, de bonne foi, son destinataire doit lui prêter (ATF 102 Ia 92, c.2, rés. In JT 1978 I 30). L'administration étant davantage versée dans les matières qu'elle doit habituellement traiter, du moins formellement, on peut attendre de sa part une diligence accrue dans l'examen des actes qui lui sont soumis, afin de leur donner un sens raisonnable, sans avoir à s'en tenir aux expressions inexactes utilisées (Egli, la protection de la bonne foi dans le procès, en Juridiction constitutionnelle et Juridiction administrative, Recueil des travaux publiés sous l'égide de la Première cour de droit public du Tribunal fédéral suisse, pp. 225ss, spéc. Pp. 236-237 et les exemples cités). De plus et selon la même logique, si le destinataire de cette plainte ne répond pas aux formes de procédures, vous voudrez bien le faire suivre d'office à l'instance compétente. Il en est de même de l'application des articles ci-dessous.

Enfin, il se réfère à la pratique constante du Tribunal fédéral en la matière, selon laquelle de tels textes sont à interpréter conformément aux intentions du plus faible, vu que vous êtes censé mieux connaître le droit qu'un citoyen de bonne foi.

1 Agression commanditée dans le métro et sur le chemin de mon domicile !

La cerise sur la gâteau, une agression récente dans le métro M2 et jusqu’à mon domicile par 3 personnes.

M. John Bagnan, l’un des agresseurs, a changé sa version, ce n'est plus dans le métro ni dans le terminus que l’agression d'une jeune fille de moins de 12 ans aurait eu lieu selon lui ( il est le seul à avoir des visions alors que le métro était plein de voyageurs et de caméras...) mais dans le passage sous voie. ( en effet, il n'y a pas de caméras dans ce passage et peu de passants et il peut dire n'importe quoi...).Il a lui-même affirmé en se vantant et bombant le torse qu’il était envoyé par une personne très puissante du Canton et que je ne pourrai rien faire contre lui vu les protections qu’il avait.

Je suis devenu un PADR selon art. 116 CPP ( une sorte de témoin) et pas un prévenu, mais ils ont essayé de me faire signer en tant que prévenu et avec une phrase comme quoi je ne voulais pas de confrontation orale, ce qui est faux. J'ai dû faire corriger le PV au moins 4 fois. Ils ont insisté pour que je retire ma plainte...

Le deuxième agresseur, M. Nicolas Roberts ( 1966 ) m'aurait braqué une lampe de poche sur le visage et pas un taser (sic), alors qu'il faisait jour à 19h30 en plein mois de mai ( les jours y sont longs...). J'aurai confondu une lampe de poche allumée avec un taser...et il ne m'aurait jamais menacé de taser...et ne saurait rien d'autre. Il est innocent de tout...et ne connaît pas John Bagnan. Il voulait juste voir mon visage (sic...) avec une lampe de poche en plein jour...( c'est Diogène ou quoi ?), c'est pourquoi in m'aurait suivi en voiture depuis le terminus du M2.

Le pire, c’est qu’on croit plus les agresseurs en bande que les honnêtes citoyens et qu’on refuse la réalité, qu’il fait jour à 19h30 à fin mai. Au final, une petite amende de Fr 30.- (sic).

2 Morts par euthanasies actives illégales de mes deux parents

Mes deux parents sont morts dans des circonstances très étranges. Le décès de mon père le le 5 février 2006 est vraiment suspect. Nous n'avons toujours pas reçu le rapport final de l'autopsie que nous attendons des autorités vaudoises depuis le mois de février 2006 qui a été demandé plusieurs fois sur recommandation du médecin qui a trouvé louche ce décès au milieu de la nuit et les deux médicaments antagonistes.

Hospitalisé au CHUV pour un très grave refroidissement sur demande d'un médecin, il est renvoyé quelques heures plus tard dans une ambulance glaciale à St Loup, hospitalisé loin des siens pour des motifs sordides et faux d'économies, vu les pressions des banques et de leurs bénéfices honteux par de la « création » monétaire du néant, qui violent la morale…( voir la démonstration ci-dessous ). Il est alors « parqué » dans une chambre d'angle et au coin Nord glaciale, fenêtre presque toujours ouverte et sans chauffage. Il lui était impossible de dormir tellement il avait froid. Le chauffage n'est ouvert que 3 jours plus tard (témoin externe à la famille).

On lui fait une interdiction d'employer des plantes qu’il utilisait depuis des mois avec succès (notamment. l'épilobe). Vu le froid, il s'infecte et il est opéré en urgence pour vider la vessie d'un drain qui reste extérieur et ouvert jusqu'à sa mort, porte ouverte aux infections.

Il est à nouveau infecté et transféré à Béthanie qui n'est pas un hôpital où il subit un traitement tardif de cette infection avec forte fièvre seulement sur ma demande insistante.

Nouveau transfert sans nous consulter à Sylvana d'un vieux Monsieur qui n'aime pas être transbahuté comme un colis au plus froid de l'hiver, tout ceci à quelques jours d'intervalles, et voici un décès très suspect vu l'administration de médicaments contradictoires ( notamment par un fort diurétique et une forte hausse de tension provoquée par un autre produit) et la visite d'une femme docteur qui insistait fortement et longuement pour faire de l'euthanasie active.

Il faut rappeler que tout ceci se déroule lors d' une élection où mon père était candidat aux élections.

Sans oublier d'autres faits troublants, concernant notre mère, qui a subi de graves mauvais traitements, avec notamment un bras cassé à l'EMS de Mont-Calme, l'ingestion de médicaments douteux et un quasi emprisonnement à l'Orme.

En effet, elle est entrée dans cet établissement en sachant marcher, et j'ai découvert de retour d'un voyage qu'elle y a été ligotée sur son lit ou sur sa chaise et en est ressortie quelques semaines plus tard impotente, avec des cloques et des esquarres…

On peut se demander si la pire conséquence ne serait pas une maladie dite d'Alzheimer. Celle-ci s'est aggravée par un traitement indélicat d'un dentiste ..., M. X..., soit une narcose avec ablation totale des dents, en profitant de l'état de faiblesse de notre mère.

Puis, par un grave accident sur la paroisse du St Rédempteur, dû à une mauvaise construction et conception d'un escalier toujours sans rambarde, qui a motivé à nouveau une narcose dommageable au cerveau de notre mère. L’escalier sur le côté de l'Église de la paroisse du St Rédempteur est toujours sans rambarde pour économiser…

Et voici que l'EMS arrête totalement de la nourrir sur ordre de la direction pendant les fêtes de Noël, sans rien nous demander car en restrictions de personnel...et elle meurt le 3 janvier…

3 Résumé de mon action contre ADP Organisation SA.

1. Un grave conflit de travail a éclaté en mai 1990, du fait des agissements peu éthiques de M. P.-M. Girard, directeur et propriétaire de la société ADP Organisation SA, juste avant une période de service militaire, qui a amené à un licenciement abusif et même à un refus de reconnaître le contrat de travail.

2. Des erreurs étaient notamment introduites volontairement dans les programmes informatiques pour faire payer des interventions voulues et planifiés par des partenaires de mèche, au détriment de sociétés privées et publiques.

3. Le Tribunal des Prud’hommes a été invoqué le 12 juillet 1990 ( 3 ans avant qu’ ADP n’ouvre action au TC, Me Pache ose affirmer le contraire par écrit, il devrait perdre sa licence…) et a décliné sa compétence le 18 avril 1996, soit six années plus tard. (Juge Zahnd)

4. Sur un jugement incident me condamnant à payer une somme de plus de Fr. 2700.-, caché par mon avocat et suite à un étrange concours de circonstance, deux poursuites lancées simultanément, l’une à mon insu, jugée le même jour à 9h00 et à 11h00, celle dont je savais l’existence, en ma faveur, l’autre me condamnant, sur le même objet, dans une seconde phase, à la faillite au début 2000, sans jugement sur le fond. Il y a même eu une audience par exemple le 17 juillet 1991 où je n’ai pas été convoqué du tout et celle-ci a été annulée plus tard. Mon employé de l’époque, M. Conza, m’avait caché l’une des poursuites.

5. Dans le cadre du jugement au fond, la partie adverse a requis les services d’un expert soi-disant « neutre » que je n’ai jamais accepté. Celui-ci m’a déclaré verbalement que le contrat de travail à 100% existait, puis dans son « expertise », revenait sur sa déclaration.

Il est de plus ou a été conseiller communal du même parti et domicilié dans la même commune que l’avocat de la partie adverse (qui nie par écrit l’avoir jamais rencontré) et que la société ADP est aussi domiciliée à Lutry, où habitent les parents de P.M. Girard et où celui-ci a passé toute sa jeunesse. Ces Messieurs osent prétendre qu’ils ne se sont jamais vus. Je ne savais pas Lutry et ses partis politiques si vastes, avec 8100 habitants et un conseiller communal, « expert neutre » proposé par un avocat qui fait aussi de la politique comme candidat dans le même parti et dans la même commune ! Voici des « pièces », mises par écrit dans la procédure, auxquelles on devrait croire ? Et toute la procédure est de la même eau et du même tonneau. Sans oublier qu’il y a un juriste Dominique Creux, juriste aussi domicilié à Lutry, amis des Nordmann. Serait-ce le Juge instructeur, qui est en même temps le juge de la cour qui a jugé de ma faillite et qui a refusé la réforme et la nomination d’un vrai expert neutre? Les autres personnes impliquées habitent-elles aussi dans le même quartier (La Conversion) de cette commune ?

6. Les bureaux ADP à Belmont, 18 route de la Louche, sont une cave humide, insalubre, froide, traitée chimiquement contre les termites et des champignons, mal éclairée par de petites fenêtres

7. L’avocat de la partie adverse, Me Daniel Pache, utilise dans le cadre de sa procédure, de pures diffamations et des calomnies.

8. De plus, dans le cadre de cette procédure et de celle du divorce de M. P.-M. Girard, des arguments anticatholiques sont utilisés avec des accents de guerre de religion d’un autre âge (carnets de prières intimes au dossier de Mme Girard, catholique elle aussi).

9. Sans compter le fait que le juge, M. Dominique Creux, du parti socialiste, est visiblement tourné contre ma personne par la partie adverse en invoquant notamment le livre « Europe, l’hiver démographique » et mes activités en faveur de la famille. Il a par ailleurs fait l’objet d’une grave enquête par mon frère Hugues, alors substitut du procureur.

10. Ce qui m’a amené à essayer de récuser le juge en question, surtout du fait qu’il n’a pas voulu exercer ses pouvoirs en ma faveur, notamment en faisant visiter les locaux insalubres.

11. Étrangement, une pièce essentielle du dossier a disparu chez Me Piguet, le livre « Une corde au cou » décrivant les agissements commerciaux de M. Girard, qui ont notamment mené une PME à la faillite, à une tentative de suicide de son directeur, puis à sa mort.

12. Ce genre d’agissements m’a été confirmé pendant mon travail chez ADP, ou notamment chez des avocats, la politique était de créer des problèmes logiciels pour venir facturer les interventions « salvatrices ».

13. La Juge du Tribunal Fédéral, Mme Nordmann comme par hasard, qui a jugé de la faillite, est une amie du Juge Creux, d’après Me Piguet. Est-elle aussi de Lutry et environ et de la famille de l’avocat Nordmann qui a menti notamment devant la cour à Vevey ?

14. Me Piguet m’avait conseillé d’obtenir des déclarations écrites de clients ADP certifiant que je collaborais avec cette société ; il m’a ensuite demandé une attestation stipulant que cette idée ne venait pas de lui. Par amitié, j’ai fait ce papier que je regrette maintenant.

15. M. Vodoz, de l’office des faillites, me dit qu’il y a désaccord sans préciser entre les offices, à voir.

Analyse

1. Cette affaire a traîné depuis plus de 13 ans, du fait de l’avocat de la partie adverse qui espace les procédures, pousse à la faillite de manière ridicule, abuse de son droit, calomnie, diffame et j’en passe.

2. Il y a plusieurs détails troublants :

2.1. Avocat et « expert » et Girard (et les Juges, not. Creux et Mme Nordmann ?) sont des amis et voisins.

2.2. Lenteurs des procédures.

2.3. Pièces non accessibles.

2.4. Pièce perdue, notamment le livre qui décrit les méthodes d’ADP et dont l’auteur s’est suicidé.

2.5. Audience où je ne suis pas convoqué.

2.6 Procédure de faillite choquante et exagérée.

2.7. Persécution religieuse et politique.

2.8. Refus de considérer des éléments importants.

2.9. Refus d’une audience publique au TF qui m’a finalement condamné sans possibilité d’analyse dans le cadre d’un vrai appel.

Les protections sociales sont violées (AVS, 2ème pilier, médecine du travail), une affaire de droit du travail traîne plus de 13 ans alors que la Suisse a signé un accord international stipulant que ce genre d’affaire de droit du travail doit être liquidé rapidement, une faillite est prononcée suite à des erreurs de fait (deux poursuites le même jour sur le même objet, l’une jugée en ma faveur, l’autre contre et à mon insu), pièces dissimulées, non accessibles ou perdues, une bibliothèque entière pleine de documents pour une affaire de peu d’importance mais gonflée à dessein pour des motifs de cupidité sordide et de collusion.

4 Anomalies manifestes qui ont bloquées mon action contre ADP

Mes positions sur les ententes secrètes entre certains Juges, avocats et l'expert ont été prouvées lors de mon premier procès civil pour une cause de droit du travail contre ADP qui a duré plus de 12 ans. Dans le cadre du jugement au fond, la partie adverse a requis les services d'un expert soi-disant « neutre » que je n'ai jamais accepté. Celui-ci m'a déclaré verbalement que le contrat de travail à 100% existait, puis dans son « expertise », revenait sur sa déclaration.

Il est de plus ou a été en tout cas à l’époque des faits sur la liste électorale et même conseiller communal du même parti et domicilié dans la même commune que l'avocat de la partie adverse (qui nie par écrit l'avoir jamais rencontré) et que la société ADP est aussi domiciliée à Lutry, où habitent les parents de P.M. Girard et où celui-ci a passé toute sa jeunesse. Ces Messieurs osent prétendre qu'ils ne se sont jamais vus. Je ne savais pas Lutry et ses partis politiques si vastes, avec 8100 habitants et un conseiller communal, « expert neutre » proposé par un avocat qui fait aussi de la politique dans le même parti et dans la même commune ! Voici des « pièces », mises par écrit dans la procédure, auxquelles on devrait croire ? Et toute la procédure est de la même eau et du même tonneau. Sans oublier que le juge Dominique Creux, juriste aussi est domicilié à Lutry, qui est en même temps le juge de la cour qui a jugé de ma faillite et qui a refusé la réforme et la nomination d'un vrai expert neutre? Les personnes impliquées habitent donc aussi dans le même quartier (La Conversion) de cette commune de Lutry. L'image de cette situation ne serait pas complète sans savoir que le Juge d'Instruction Civil qui a instruit cette affaire se trouve être aussi le Président de la Cour Civile qui a conduit l'audience du 27 avril 2001 et qui n'est autre que le fonctionnaire Dominique Creux. Si on ajoute à cela que la famille Creux et celle de son avocat Nordmann et de Mme la juge au TF Nordmann sont en conflit avec la famille de Siebenthal depuis des décennies, que de ce fait le magistrat qui a conduit cette instruction et l'a ensuite jugée ne pouvait humainement pas être objectif, et impartial, on comprend alors aisément les multiples abus d'autorité, de pouvoir et autres vices de procédures dont a été victime François de Siebenthal lors du jugement du 27 avril 2001.

Pour confirmer cette affirmation, au Tribunal d'Arrondissement de l'Est vaudois – Audience du 23.02.2004 sous la présidence de l'Avocat Me Stefan DISCH, aussi un ami et proches des Nordmann ?…

Juge Dominique CREUX contre Gerhard ULRICH et Marc-Etienne BURDET

Dans ce contexte il est apparu clairement lors de la déposition du Témoin François de Siebenthal, que ce dernier avait été trompé par son propre avocat Micheli de l’étude NORDMAN, qui était ami du juge Dominique CREUX et se présentait aujourd'hui à ses côtés. Cet avocat Nordmann a tenté dans un premier temps de nier qu'il connaissait François de Siebenthal, argumentant qu'il ne le connaissait qu'au travers d'affiches des campagnes électorales… alors que François de Siebenthal n'a pas encore fait imprimer à l'époque d'affiches le concernant… mais que cet avocat était celui d'Edipresse contre son père Jean, alors diffamé honteusement dans le journal Le Matin notamment, avec plus de 20 graves erreurs, de fait, diffamantes, calomniatrices et pures mensonges, sans compter une caricature en Hitler…. De plus, quand François de Siebenthal a précisé qu'il disposait de factures de l'étude de l'avocat pour honoraires de Me Micheli ( qui l'a découragé sournoisement de faire recours à Strasbourg…), celui-ci a simplement baissé la tête, pris au piège de ses propres mensonges. Sur ce point, M. DE SIEBENTHAL a eu la confirmation aujourd'hui que le juge CREUX et son avocat NORDMAN l'avaient trompé, puisque lorsqu'il avait demandé la récusation du juge CREUX à l'époque à cause d'un conflit entre les deux familles, celui-ci avait refusé et a même conduit toutes les procédures contre lui, tant comme Juge d'instruction civil, qu'à la Cour civile ou encore à la Cour des poursuites et que NORDMANN ne s'était pas récusé d'office… Les preuves successives, évidentes démontrent que le juge CREUX ne recule devant aucun abus pour parvenir à ses fins. Le juge ad hoc Disch était de mèche avec la partie adverse.

Dans tout procès, aucun témoin ne se présente avec les classeurs des procédures dans lesquelles il a été tordu. François DE SIEBENTHAL est donc venu témoigner sans ses 10 classeurs fédéraux... et mal lui en a pris... Stefan DISCH, le jude ad-hoc, président (sic!) de la journée, a voulu étayer les déclarations du Citoyen témoin, laissant bien entendu un délai impossible à tenir pour fournir les pièces requises. François DE SIEBENTHAL a pourtant rapidement fouillé dans ses classeurs et directement faxé les pièces en question, que le "président" a dit ne jamais avoir reçues... Il est simple de le prouver est examinant les archives Swisscom qui ont la trace de ce fax envoyé le jour même, du no 021 616 88 81 au numéro fax du tribunal de Vevey.

Il est clair qu'à l'appui des pièces en questions, le jugement qu'il a rendu n'aurait plus été possible !

Pour bien comprendre toute cette machination, il faut se souvenir que Dominique CREUX est en conflit contre la Famille DE SIEBENTHAL depuis des années, voire des décennies.

C'est ainsi qu'il n'a jamais pardonné d'avoir dû se présenter à l'époque devant le Substitut du Procureur Hugues DE SIEBENTHAL comme "témoin" dans une affaire de blanchiment d'argent. Sa haine des DE SIEBENTHAL a ensuite conduit le substitut du Procureur Hugues DE SIEBENTHAL à démissionner et le harcèlement dont il a été victime l'a conduit à une dépression sévère. Il est aujourd'hui toujours soigné car en dépression et assume toujours très mal cette situation.

Il leur était donc facile, lors de l'audience de mercredi dernier 23 février 2005, de déstabiliser ce témoin fragile, en l'accusant de trahir le "secret de fonction" lié à sa fonction précédente... Stefan DISCH s'est très bien prêté au petit jeu de l'avocat de CREUX, Philippe NORDMANN ! Ainsi déstabilisé, Hughes DE SIEBENTHAL n'a plus pu parler ouvertement, s'est complètement renfermé et s'est contenté de dire que CREUX avait été auditionné comme témoin dans cette affaire de blanchiment.

Pourtant, cette seule déclaration aurait suffi à concéder l'application de l'Art. 173 §2 du Code Pénal Suisse. Bien sûr pas pour le complice d'Escroc Stefan DISCH...!!! N'oublions pas que les preuves de la mauvaise foi de CREUX sont évidentes dans une multitude de dossiers, même si dans le cas présent, l'instruction pour couvrir CREUX n'a pas permis de démontrer la même évidence !

Le jugement a été rendu vendredi 25 février 2005 à 16.00 H. Le délai de recours a été fixé par le pseudo président Stefan DISCH au mardi 1er mars 2005, soit après deux jours ouvrables... Probablement là aussi une particularité vaudoise... Mais on n'est plus à une vacherie près !

Public témoin présent à l'audience :

· Henri WEIS, Gilamont 56 – 1800 Vevey

· Joseph FERRAYE, case postale 41 – 1231 Conches

· Sylvain COLLAUD, case postale 5728 – 1002 Lausanne

· Isabelle PROSINA, rue de Lausanne 115 – 1202 Genève

· Marie-Jeanne DESCLOUX – 1626 Romanens

· Birgit SAVIOZ – 1694 Villargiroud

· Marcel CAPT – 1410 Thierrens

· Françoise PIRET, Rue des Eaux-Vives 9 – 1207 Genève

· Margaretha GUTKNECHT, Au Duché – 1542 Rueyres-les-Prés

· Hans HIDBER, Heinrichstr. 210 – 8005 Zürich

· Daniel CONUS, 1624 Grattavache

· Rémy MEURET, av. de la Pontaise 29 – 1018 Lausanne

· Gerhard Ulrich

· Marc-Etienne Burdet

· François de Siebenthal , Ch. Des Roches 14 – 1010 Lausanne

· Hugues de Siebenthal, Epalinges

5 Intérêts communs partagés entre certains acteurs judiciaires

Pour comprendre ces affaires, il est indispensable de faire la relation entre tous les intervenants de cette machination, copains politiques ou de quartier qui ont usé et abusé de leur position professionnelle dans cette affaire. Voir mon courrier à la Juge de cette cause pour demander un avocat d'office ou la récusation refusée du Juge Creux.

Vu tous ces éléments et contrairement aux affirmations du Tribunal neutre vaudois dans l'arrêt du 14.03.06 , le Conseil Supérieur de la Magistrature Italien a interdit depuis 93 aux magistrats d'appartenir à une loge maçonnique. La justice anglaise, quant à elle, oblige ses magistrats francs-maçons à le faire savoir de la façon la plus claire. En Suisse, dans le même temps, juge, experts et avocats francs-maçons continuent chaque jour à protéger leurs "frères", qu'ils soient plaignants ou accusés. Nombre de justiciables ayant eu affaire avec la justice ces dernières décennies ont bien souvent été confrontés à la partialité parfois brutale de divers tribunaux - notamment les tribunaux vaudois - jusqu'au jour où ils ont réalisé que leurs adversaires étant francs-maçons, ceux-ci avaient ainsi bénéficié de protections choquantes et scandaleuses.

En effet, le serment maçonnique de solidarité fraternelle oblige fortement tous ceux qui le prête à protéger leurs "frères" et ce quelques soient les circonstances.

Les magistrats indépendants de la franc-maçonnerie commencent à comprendre que c'est leur honneur et leur légitimité de magistrats qui sont désormais en cause. Certains d'entre eux attendent avec impatience que la Suisse s'aligne enfin sur les pratiques européennes et accepte de séparer formellement la justice et la franc-maçonnerie. La justice est, chaque jour, en complète contradiction avec le droit européen, notamment l'article 6 de la Convention Européenne des Droits de l'Homme. Cet article 6 de la Convention accorde à tout citoyen d'un pays signataire le droit à "un procès équitable rendu par un tribunal impartial". Or, dans l'état actuel du fonctionnement de la justice et compte tenu de l'utilisation abusive de ses institutions par les réseaux maçonniques, dès l'instant où un justiciable franc-maçon se présente devant un tribunal, il devient strictement impossible de considérer le tribunal comme impartial. En effet, aucun citoyen ordinaire ne peut savoir, compte tenu du caractère occulte de la franc-maçonnerie, quel magistrat en fait ou non partie. Mais comme, par ailleurs - tous les experts s'accordent sur ce point - environ 60% de la magistrature fait partie de la franc-maçonnerie, il devient alors hautement probable que face à n'importe quel tribunal, tout citoyen plaignant ou accusé se trouve face à au moins un magistrat franc-maçon : si la partie adverse est effectivement membre de la franc-maçonnerie, alors, adieu l'impartialité du tribunal, au sens du droit et bienvenue au délit d'entrave à l'exécution de la justice.

Je demande donc qu'il soit demandé par écrit à toutes les personnes impliquées dans un procès si elle est membre d'une société secrète ou d'un club service du type Lions ou autres.

De plus, le 13 juin 2006 notamment, un jugement pénal inique est prononcé à mon encontre, résultat de nouvelles persécutions.

Le président, Mme Marianne Fabarez-Vogt, fait partie du Lions Club Lausanne-Riviera, MD102, organisation proche des francs-maçons, qui a toujours encouragé les avortements, l’euthanasie et le suicide assisté.

Son jugement comporte des mensonges, des inexactitudes, des calomnies, des atteintes à l'honneur…

J'ai porté plainte contre elle, contre la Télévision suisse romande et X pour diffamation (art. 173 CP), calomnie ( 174 CP), vol en bande ( art. 139 CP), Corruption ( 322 ss CP) en alléguant notamment la violation de l'art. 6 § 1 CEDH,

«Toute personne a droit à ce que sa cause soit entendue équitablement [et] publiquement (…), par un tribunal indépendant et impartial, établi par la loi, qui décidera (…) du bien-fondé de toute accusation en matière pénale dirigée contre elle. Le jugement doit être rendu publiquement, mais l'accès de la salle d'audience peut être interdit à la presse et au public pendant la totalité ou une partie du procès dans l'intérêt de la moralité, de l'ordre public ou de la sécurité nationale dans une société démocratique, lorsque les intérêts des mineurs ou la protection de la vie privée des parties au procès l'exigent, ou dans la mesure jugée strictement nécessaire par le tribunal, lorsque dans des circonstances spéciales la publicité serait de nature à porter atteinte aux intérêts de la justice.».

Summus ius, summa injuria. Trop de droit provoque la pire des injustices. Il y a fréquemment des injustices consistant à chercher chicane aux gens et à interpréter subtilement le droit. De là, cette maxime devenue proverbe : "summum ius, summa injuria". Beaucoup d'actes immoraux de cette sorte se commettent au nom de l'intérêt cupide et malsain : on cite un chef d'armée qui, après être convenu avec l'ennemi d'une trêve de trente jours, ravageait de nuit son territoire parce que, disait-il, le pacte conclu s'appliquait aux jours, non aux nuits.

L'avocat commis d’office m'ayant indiqué de fausses dates pour le délai de recours au TF et vu ma maladie provoquée par le stress de toutes les affaires que vous lirez ci-dessous, je l'ai déposé peut-être avec un jour de retard.

Dans l'affaire, le notaire public Pierre Badoux a rédigé lui-même une trêve avec réticence mentale et fausses promesses pour soi-disant clore toute cette affaire, en sachant très bien que ce n'était qu'une étape pour me voler le fruit d'années de dur travail dans des affaires très compliquées.

J'attire votre attention sur le fait que la bonne foi des parties adverses est absente. M. le notaire Badoux par exemple ayant raté un rendez-vous important sans explications ni excuses, ayant jugé avant d'avoir toutes les pièces, fait signer par dol une convention pour récupérer en plusieurs phases le maximum d'argent et surtout tous les classeurs et pièces en ma possession et en sachant sciemment que ladite convention ne serait jamais applicable et ayant présenté tous les faits à mon détriment et de manière injuste pour me faire condamner à l'infamie, un soi-disant abus de confiance que lui-même pratique avec délectation.

La cour de district a fait le jeu du notaire sur cette déclaration signée avec des arguments mensongers, convocation avec des gendarmes à mon domicile privé, alors que j'avais attiré l'attention à la cour et à la greffière sur mon nouveau domicile et un juge instructeur qui refuse de faire produire l'entier des classeurs fédéraux.

6 Affaire de mort suspecte

+ Georg Brozicek-Müller, haut franc-maçon défénestré à Vevey (en mars 1997)

Le 4 février 1997, le Journal de Genève publie en 1ère page : « Où sont passés les milliards du Koweït ? » Cette édition sera notamment en France immédiatement mise en invendue sur ordre !

En mars 1997, M G. Brozicek est défenestré à Vevey…alors qu'il était en négociation avec notamment des français chargés d'investir d'énormes sommes. La providence a voulu que sa veuve me remette toutes les affaires de son mari franc-maçon, actif dans le pétrole et tué à Vevey par défenestration, devant les locaux de Nicod SA. J'ai signalé cette mort par probable assassinat notamment au Juge instructeur Chaton, à M. le Notaire Badoux et à la Juge Mme Fabarez mais personne n'a donné suite en Suisse et j'ai dû agir aussi en Tchéquie. Ces recherches donnent notamment les résultats suivants:

» Le 24 juillet 2001, (Le Matin, Journal suisse) publie : Sa voiture explose : meurtre ou suicide ?

» André Sanchez, homme d'affaires français basé à Lausanne, meurt dans l'explosion de sa voiture à Essertines-sur-Rolle. Le Directeur de la société de Lausanne est décédé il y a deux mois dans des circonstances troublantes. L'homme craignait pour sa vie. Mais, André SANCHEZ avait enregistré une cassette avant sa mort.

M. Sanchez nous avait été présenté pour investir d'énormes sommes notamment aux Philippines. Me Rossel, avocat, Grand-Rue 89, 1110 Morges/VD en est notamment témoin.

Refus des autorités vaudoises de faire une enquête sur ces morts suspectes…

On peut de poser la question d'entente secrètes vu les énormes sommes en jeu, des milliards de dollars payés par le Koweït.

7 Affaire contre Mme Georg Brozicek-Müller

Je signale notamment les points suivants:

Parti pris évident et abus d'interprétation de mes paroles.

Refus de protocoler que le notaire „témoin" a reconnu en audience n'être pas venu à un rendez-vous sans m'avertir ni s'excuser, qu'il a fait signer de mauvaise foi une convention en faisant croire que tout serait réglé, alors qu'il est un officier de l'Etat assermenté.

En page 14 du Jugement, une correction à la plume qui „serait une tricherie" alors que c'est l'avocat qui viole la déontologie, ce qui devrait être poursuivi d'office.

Toujours en page 14, un sous-entendu que j'aurai fait une faux lors de l'ouverture du compte en banque, ce qui est une calomnie.

En page 15, je n'ai jamais admis avoir reçu tout ce qui m'est dû, contrairement à ce qui est écrit.

Il ressort du dossier que certaines assurances abusent de leurs pouvoirs. Le fait que Madame Müller-X ait fait des arrangements et des visites sans me tenir au courant est aussi un abus de confiance, prouvé par sa lettre écrite à la Winterthur/Axa et versée au dossier pénal où elle affirme exactement le contraire, alors qu'elle-même et son notaire m'encourageaient encore à l'époque à me battre. Le directeur d’Axa est maintenant celui des Bilderberg.

Le requérant invoque son rôle d'économiste pro vie et pro famille ainsi que le contexte politique et social de son action. L'efficacité de celle-ci dépendrait de la confiance dont il jouit auprès du public, surtout quant à la gestion des sommes versées par les donateurs aux associations créées par lui; par conséquent, la manière dont le traite la justice constituerait une atteinte aux causes qu'il défend. Ses nombreuses démonstrations irriteraient ses adversaires politiques qui, appuyés par une «partie de l'appareil judiciaire vaudois», s'efforceraient de nuire à sa réputation. Ce procès, véritable «tracasserie contre un opposant », s'inscrirait dans le cadre d'une campagne de harcèlement menée contre lui.

Je voudrais aussi que toutes les pièces en main de la justice vaudoise soient au dossier, y compris la correspondance et les deux émissions vomitives du fond de la corbeille de la TSR, ainsi que les documents internet qui affirment que le cocktail Molotov était un faux attentat, sous-entendu que je serai un manipulateur….

Dernière ligne droite électorale 12.11.2003 13:49

24.11.2003 15:21 Mise à jour

La campagne pour la succession de Philippe Biéler au Conseil d'Etat vaudois touche à sa fin. Dimanche 30 novembre, c'est normalement François Marthaler (Les Verts) qui devrait être élu au gouvernement. Quant à l'indépendant François von Siebenthal, seul le faux attentat à la bombe devant ses bureaux aura marqué sa présence durant la terne campagne du second tour. TSR/G.-O. C.

http://www.tsr.ch/tsr/index.html?siteSect=200003&sid=4444142

MOYENS

I.- Les premiers juges ont retenu ce qui suit :

« Au vu de ce qui précède, force est de constater que François de Siebenthal a prélevé indûment à tout le moins plus de CHF 70'000.- pour son propre compte, sur une somme qui lui avait été confiée dans l'attente de la transférer à sa mandante. Celle-ci lui avait en effet donné des instructions pour qu'il conserve ce montant en compte » (jgt, p. 15). Ils ont ainsi condamné le soussigné pour abus de confiance. Or, le soussigné n'a jamais reçu de telles instructions. Comme on le verra, c'est de manière arbitraire que le tribunal est arrivé à la conclusion inverse, en violant l'article 411 lettres g, i et j CPP.

II.- Pour retenir que Mme X avait donné des instructions au soussigné, le tribunal s'est fondé exclusivement sur le courrier de celle-ci du 2 septembre 2003 dans lequel elle disait au soussigné qu'elle lui avait demandé, en mars 2000, de laisser l'argent versé son nom par Helvetia Patria et par La Bâloise (jgt, p. 15 ; P. 6, annexe 5).

En guise de motivation, le tribunal s'est borné à dire ce qui suit : « Il n'y a pas de raison de mettre en doute l'instruction qui aurait été donnée en mars 2000, quand bien même cette instruction ne résulte pas d'une pièce écrite autre que celle constituée par la lettre du 2 septembre 2003 » (jgt, pp. 15 s.).

Or, précisément, il y a des raisons de mettre en doute ladite instruction: In dubio pro reo.

- Tout d'abord, comme l'a relevé le tribunal, il n'y a aucune pièce au dossier, autre que le courrier du 2 septembre 2030, qui vient étayer cette thèse. Or, ce seul courrier est manifestement insuffisant pour fonder la condamnation du soussigné dans la mesure où il ne s'agit que d'une déclaration d'une partie au procès pénal. De surcroît, non seulement il n'existe pas d'autres pièces au dossier mais aucun témoignage ne vient confirmer l'instruction qui aurait été donnée par Mme X.

- Ensuite, dans son courrier du 2 septembre 2003, Mme X affirme qu'elle a constaté en mars 2003 que le soussigné s'était servi sans même le lui demander.

Cette affirmation est cependant contredite par les pièces au dossier, en particulier par l'annexe 4 de la pièce 6, d'où il ressort que Mme X connaissait l'existence des prélèvements litigieux dès le début de l'année 2001. On y reviendra plus loin (III).

- Enfin, toujours dans son courrier du 2 septembre 2003, Mme X écrit que « par fax alors je vous demandais de m'envoyer immédiatement cet argent et les papiers confirmant votre ordre de paiement ».

Or, ici également, il n'y a aucune pièce ni aucun témoignage qui vient étayer cette affirmation. Cela est d'autant plus étonnant que, contrairement à un courrier, un fax reste en mains de son expéditeur. Dès lors, si ce fax avait existé, il serait en possession de Mme Brozicek-Müller et elle n'aurait assurément pas manqué de le produire.

Au vu de ces éléments, on peut sérieusement douter de la véracité des propos contenus dans le courrier de Mme Georg Brozicek-Müller du 2 septembre 2003. Partant, il existe manifestement un doute important quant à l'existence d'une instruction de Mme Brozicek-Müller et le tribunal ne pouvait donc pas se déclarer convaincu de l'existence de ce fait, défavorable au soussigné, sans violer le principe in dubio pro reo en tant que règle d'appréciation des preuves (art. 411 litt. i CPP). Ce faisant, le tribunal a également violé le principe in dubio pro reo en tant que règle sur le fardeau de la preuve (art. 411 litt. g CPP). En effet, la charge de la preuve incombe à l'accusation, en l'occurrence à Mme Georg Brozicek-Müller, qui n'a pas rapporté la preuve de l'existence d'une instruction. A tout le moins, le doute à ce sujet devait profiter au soussigné. Le tribunal a enfin violé l'article 411 litt. j CPP, sa motivation quant à l'existence d'une instruction étant manifestement insuffisante.

III.- C'est également de manière arbitraire que les premiers juges ont retenu que Mme Georg Brozicek-Müller n'avait reçu le relevé de compte de la Banque Migros faisant apparaître les mouvements litigieux (P. 6, annexe 4) qu'en 2003, à sa demande (jgt, p. 16).

En effet, il ressort clairement du relevé de compte en question que celui-ci a été expédié le 31 décembre 2000 à son adresse :

Mme Georg Brozicek-Müller en a donc eu connaissance dans le courant du mois de janvier 2001.

Malgré le libellé clair de ce relevé, le tribunal a retenu qu'il ressortait notamment des pièces d'ouverture du compte que tout le courrier était adressé à François de Siebenthal .

Il est certes exact que la carte de signatures du compte (P. 9, annexe 1) mentionne, sous la rubrique « Observations », « Corr. à M. François de Siebenthal , av. Dapples 23, 1006 Lsne ». D'ailleurs, un relevé de ce compte (P. 6, annexe 3) a été envoyé le 31 mars 2000 à l'adresse du soussigné :

Cependant, les adresses différentes mentionnées sur ces deux relevés, la première c/o le soussigné le 31 mars 2000 et la seconde chez Mme Georg Brozicek-Müller le 31 décembre 2000, démontrent bien que l'adressage a été modifié dans le courant de l'année 2000 et que le second relevé a été adressé directement à Mme Brozicek-Müller à Prague. Si tel n'avait pas été le cas, on n'expliquerait pas pourquoi la Banque Migros aurait changé le libellé de l'adresse.

Ainsi, au vu des pièces au dossier, force est de constater que Mme Georg Brozicek-Müller a eu connaissance des prélèvements litigieux du soussigné au début de l'année 2001, soit à réception du décompte de la Banque Migros du 31 décembre 2000. Or, elle ne s'est jamais plainte de ces prélèvements avant le 2 septembre 2003, soit durant près de trois ans ! Le témoin N. Abibi a d'ailleurs confirmé en audience que, lors d'une réunion du 18 mars 2003 (P. 22, annexe 10), Mme Georg Brozicek-Müller, si elle avait affirmé qu'elle souhaitait que l'affaire avance plus vite, ne s'était pas plainte du montant des honoraires prélevés par le soussigné (procès-verbal d'audience, p. 9). Le silence de Mme Georg Brozicek-Müller durant près de trois ans démontre bien que le soussigné était en droit d'effectuer ces prélèvements pour faire avancer ces affaires délicates ( pétrole libyen et irakien, centrales nucléaires dans les pays de l’Est, Cliniques Générales de santé, Fefdoce, etc…). Enfin, et par surabondance, c'est de manière arbitraire que le tribunal a retenu que Mme Georg Brozicek-Müller avait elle-même demandé le relevé litigieux en 2003. Cela ne ressort en effet d'aucune pièce, pas plus que de la plainte pénale déposée par Mme Georg Brozicek-Müller, par l'intermédiaire du notaire Badoux (P. 5).

Au vu des éléments au dossier, les premiers juges ne pouvaient que retenir que la Banque Migros avait envoyé directement à Mme Brozicek-Müller à Prague le relevé de compte du 31 décembre 2000. En retenant une autre version, défavorable au recourant et étayée par aucun élément de preuve, le tribunal a violé les articles 411 lettres g et i CPP.

Sa duplicité est prouvée par sa dernière lettre à la Winterthur, où elle écrit que tout est arrangé, alors que le notaire Badoux m'encourageait encore à continuer la procédure, et que je serai payé en cas de succès. D'autant plus qu'elle m'a vendu un véhicule en affirmant qu'il avait 140'000 km alors qu'il en avait plus de 400'000 et que son mari, à l'Assurance Invalidité suisse pendant des années, gagnait des millions avec ses affaires dont j'ai retrouvé les traces, de comptes et de nombreuses sociétés, notamment depuis Genève ( notamment dans les caves de ses 2 villas) et sur lesquels je devrai être payé, ce qui m'a été refusé.

Pour ce qui est de la campagne de presse haineuse, diffamatrice et calomniatrice contre moi, elle s'explique pour notamment les raisons suivantes

Il y a plusieurs années que j'ai dû faire des recherches sur les sociétés secrètes.

La piste suisse de Clearstream et du Koweït Gate, affaire Ferraye. avec la mort de notamment M. Sanchez, avec qui j'étais en affaire sur les Philippines.

Le monde va de plus en plus mal à cause de leur cupidité honteuse et cynique...

Le doute éventuel doit profiter à l'accusé, surtout vu le caractère infamant et vexatoire des autorités vaudoises, accentué par l'envoi du panier à salade policier à deux adresses, pour bien faire voir à tous les voisins la pression politique sur le prévenu, faits reconnus dans le jugement par un rabais financier ridicule sans commune mesure avec l'atteinte à la personnalité. J'avais pourtant demandé à Mme la Greffière de bien noter ma nouvelle adresse.

Je demande aussi que cette instruction soit confiée à un magistrat neutre, qui ne soit membre d'aucune des organisations secrètes ou discrètes de « petits copains » cités et que je sois dédommagé largement vu les graves atteintes à ma réputation et honneur et que tous les liens du style http://www.tsr.ch/tsr/index.html?siteSect=200003&sid=4444142 soient retirés d'internet.

J' ai toujours affirmé par écrit, notamment dans ma correspondance à la Juge, que ces montants étaient des honoraires pour moi-même et les trois collaborateurs qui ont travaillés pendant des années, au début en risque pur, pour des années de travail et de recherches dans plusieurs pays et des avances sur commissions sur les fonds gigantesques retrouvés et en lien avec les milliards des fonds Ferraye.

La convention du notaire Badoux est entachée de mauvaise foi ab ovo par dol éventuel car la plainte pénale a été maintenue, alors qu’il était évident qu’elle était téméraire et diffamatoire, comme on l’a démontré lors de toutes ces procédures iniques.

8 Affaire Naghi Gashtikhah

Il est de notoriété publique que ce diplomate a VOULU remettre Fr 500'000 fr à François de Siebenthal pour financer les frais de l'Etat pour l'élection complémentaires au Conseil d'Etat, montant qui est toujours séquestré et qui a été refusé par le Canton pour manque de base légale.

M. Strub, directeur de banque ( Indiana, puis Anker Bank, puis Banque Cantonale de Genève, puis Chase) l'a volé il y plus de 20 ans…de plusieurs millions. Comme cerise sur le gâteau, l’État de Vaud l'a mis à tort en prison pour plusieurs mois sans raisons et sans dédommagements et lui a confisqué plus de 750'000.- Fr. sans aucun décompte justifié. Il y a des évidences que la banque a comploté avec son ex-directeur et son complice (l’interprète), et qu'elle profite d'un trafic d' influence en coulisses.

Le harcèlement judiciaire de Naghi Gashtikhah dure déjà depuis plus de 20 ans, et son affaire remplit une quinzaine de classeurs. Le montant de Fr 500'000.- toujours séquestré injustement m’est dû.

9 Séquestre sans motif de 500.000Fr de financement de ma campagne électorale

Il m'a été reproché, pour la première fois de l'histoire, le coût d'une élection de Fr 500'000.-. Dans les autres cantons, ils se plaignent au contraire qu'il n'y a pas assez de candidats et font recours pour annuler des élections tacites. Nous savons que les contribuables vaudois sont saignés à blanc et que chaque franc compte. Ces 500'000.- Frs sont trop élevés ? Comment est-ce possible qu'une élection coûte si cher ? Ces deux élections ont été provoquées par la démission, en milieu de mandat, des élus de gauche. Ces 500'000 Frs ont été volés par un système mafieux et franc-maçon. Un diplomate étranger qui habite depuis plus de 20 ans en Suisse appuie ma candidature en ayant déjà contribué de exactement 500'000 Frs. du compte MN 120'959 de la Banque Bruxelles Lambert à Lausanne au compte de l'Etat de Vaud. L'Etat de Vaud avait alors refusé cette offre "par manque de base légale". Le tribunal cantonal, après l'avoir tout d'abord nié, a finalement reconnu par écrit que cet argent existe bel et bien et reste encore bloqué. C'est argent m'est donc dû vu que le canton a refusé ce montant et que le TC a reconnu que cet argent est toujours sous séquestre, sans aucune raison ni légale ni morale.

10 Liens entre les affaires vaudoises

Les scandales foisonnent : BCV – FAREAS – Caisses de pensions – Offices des poursuites et faillites – Même la comptabilité du Canton qui doit être tenue dans un Canton confédéré parce que nos autorités ne maîtrisent plus rien, notamment leurs informaticiens financés à coup de dizaines de millions et qui n’ont fait que rendre le système aussi perméable qu’un Gruyère. Pourtant, là les responsables n’ont jamais été inquiétés… Qui donc les soutient et a un intérêt direct à ce que cela ne change pas ? Une chose est sûre, c’est que ceux qui trinquent sont les contribuables.

Il est intéressant d’observer la structure du Tribunal Cantonal vaudois. Tout est dédié à la gloire de cette secte secrète qui est la Franc-maçonnerie. Dès l’entrée extérieure, les initiés y voient leurs symboles, deux fois trois colonnes avec des triangles et les trois points sur les colonnes. Trois coins, 3 points… la démocratie et la justice sont impossibles avec des sociétés secrètes dont les vrais chefs et les buts sont occultes. La Belgique nous en a montré l’exemple dans l’affaire Dutroux et ses 19 « suicides », les centaines de tests ADN écartés etc.

Nous devons nous unir pour reconstituer la toile tissée par ces sociétés secrètes et dénoncer pénalement leur corruption, les combines, les collusions et les vols perpétrés entre autres par les systèmes informatiques. C’est pourquoi je lance ici un appel à témoins à tous les Citoyen(ne)s qui pourraient avoir été spectateur d’une irrégularité.

Certains « juges » jugent les yeux fermés et favorisent leurs « frères » secrets et occultes. L’un de ceux-là qui agit au service de la secte, n’est autre que Dominique CREUX domicilié à La Conversion. La famille Creux est en lutte avec la famille de Siebenthal depuis des générations. Il a refusé sa récusation alors qu’il était en conflit avec les frères du soussigné depuis des décennies. N’est-ce pas le témoignage d’une justice en crise dans laquelle les « juges » qui la représentent abusent de leur autorité à des fins personnelles en bafouant les Droits constitutionnels ?

Si vous avez connaissance de faits dans lesquels « témoins » et « experts » seraient subordonnés par des ententes secrètes, notamment par le « juge » cantonal socialiste Dominique Creux, l’« avocat » libéral Daniel Pache, l’« expert » libéral Georges Claudet de la fiduciaire Fidussa, la société ADP/Organisation et M. Pierre-Martin Othenin-Girard qui a maintenant simplifié son nom en Pierre Girard ou Martin Girard, son propriétaire informaticien qui triche les programmes… alors faites m’en part dès que possible. Sont-ils tous francs-maçons ? Il y en a dans tous les partis, qui copinent et courent ensemble. Ces quatre-là sont tous domiciliés à la Conversion/Lutry… et osent prétendre qu’ils ne se connaissent pas… !

http://desiebenthal.blogspot.ch/2010/10/debacles-informatiques-par-milliards-en.html

11 Les tribulations de Finalités et du CDC.

Les articles de "La Tribune-Le Matin" et de "24 Heures"

L'hebdomadaire VSD, ayant puisé à des sources douteuses (syriennes), évoque la présence près de Martigny d'une école de cadres néo-nazie.

Aussitôt l'idée d'un amalgame s'introduit dans l'esprit de quelques-uns et Liliane Varone prend la plume pour produire le 15 octobre 1980 dans "La Tribune-Le Matin" et dans "24 Heures" un article de première grandeur au sens typographique, mais constituant une vilenie. Le 23 octobre paraît dans "24 Heures" une rectification conforme au droit légal de réponse, tandis que ce même jour la Tribune récidive par un nouvel article de Liliane Varone comportant au minimum 25 affirmations erronées et malveillantes pour la plupart.

"Le Nouvelliste" a clairement démonté ces procédés, qui ne déshonorent que leurs auteurs. "La Nation" a relevé qu'il ne suffit pas d'avouer finalement le caractère "bidon" de l'école de cadres, mais qu'il s'agit bel et bien de présenter des excuses aux personnes ou institutions lésées par l'amalgame. Des lecteurs de grands quotidiens ont exprimé également leur indignation.

Cette circonstance permet de préciser deux choses :

•a) la nature de l'amalgame et

•b) les distinctions entre le séminaire d'Ecône, I'Office Suisse et l'Office international.

L'amalgame (article du 15.10.1980)

"L'article rapproche et amalgame des sociétés qui n'ont rien à voir entre elles. A savoir :

a) I'école de cadres pour néo-nazis en Valais (qui n'existe pas),

b) le séminaire d'Ecône, qui s'occupe de tout autre chose,

c) les guérilleros du Christ-Roi, qui n'ont aucun lien avec notre pays,

d) enfin la famille de Siebenthal et la revue FINALITES dont l'action tend à répandre la connaissance de la doctrine sociale chrétienne."

(extrait de la rectification parue dans "24heures").

Qu'est-ce que l'amalgame ?

C'est un procédé de journaliste ou de propagandiste qui consiste à créer la confusion entre la personne ou l'institution que l'on veut discréditer et une autre personne ou institution qui lui est étrangère, mais dont les théories ou des actes font déjà l'objet d'un jugement négatif de l'opinion publique. C'est à la fois une malhonnêteté intellectuelle et un procédé blessant contre celui qui en est la victime. Liliane Varone a voulu transférer sur Ecône et Finalités les jugements réflexes suscités par le nazisme, sans pouvoir fournir l'ombre d'une preuve. Se rendant compte du néant de sa position, elle trouve ensuite le moyen d'imaginer un mélange entre l'Office international et l'Office Suisse, puisant à des sources tout aussi douteuses. "La Tribune" publie alors le 18 novembre la rectification ci-dessous (p. 317). Il convient de bien préciser ceci : le séminaire d'Ecône, I'Office Suisse et l'Office international n'ont entre eux aucune relation de subordination ou de coordination : ces organisations ne se "mélangent" nullement. Dire que "Finalités" n'a rien à voir avec le séminaire d'Ecône est réel, en ce sens que le rédacteur de la Revue n'a jamais reçu la moindre lettre ou instruction de l'évêque. Force est cependant d'observer que les prêtres issus d'Ecône sont allergiques à la Révolution et se trouvent être implicitement des défenseurs du droit naturel et chrétien, ce dont l'Office Suisse leur est reconnaissant. Mais leur action se situe au plan spirituel, tandis que la nôtre se place au plan civique. De plus, rares sont les prêtres diocésains qui soutiennent en fait la doctrine sociale de l'Eglise prise dans son ensemble : la liturgie et les homélies penchent souvent vers le collectivisme. Finalités n'a rien à voir non plus avec l'Office international dans le même sens. Jamais Finalités et l'Office Suisse n'ont reçu d'instruction de Paris, rue des Renaudes. Cependant nous sommes reconnaissants à l'Office international de nous avoir révélé l'ampleur du droit naturel et chrétien, et notre devoir de piété à cet égard est grand. Que cet Office et le séminaire d'Ecône n'entretiennent pas les meilleures relations ne nous concerne pas. Nous rendons hommage à l'un et à l'autre dans la mesure où leurs doctrines nous aident à soutenir en Suisse un civisme chrétien. L'action des collaborateurs de la Revue "Itinéraires" en ce sens est exemplaire et nous sommes heureux d'avoir pu récemment accueillir MM. Jean Madiran et Hugues Kéraly. Nous souhaitons sortir ainsi lavés d'accusations bien inutiles.

Rectification de La Tribune-le Matin du 18.11.80

PRÉCISIONS DE LA DROITE CATHOLIQUE Le titre est en soi une nouvelle manipulation... Il y a Office et Office Le 15, puis le 23 octobre dernier, le "Tribune-Le Matin" publiait deux articles sur la droite catholique; ils faisaient suite à l'affirmation–démentie depuis– de l'hebdomadaire français VSD selon lequel existait en Valais, une école néo-nazie. Précisément mis en cause, Jean de Siebenthal, l'un des animateurs de la revue Finalités, tient à préciser ce qui suit :

Il n'y a aucun rapport organique entre:—d'une part le Centre de documentation civique (Suisse) qui utilise également la dénomination d'"Office suisse de formation et d'action civiques selon le droit naturel et chrétien"; —d'autre part l'" Office international des œuvres de formation civique et d'action culturelle selon le droit naturel et chrétien", institution française. Le premier diffuse la revue Finalités, ainsi que de la littérature, des documents pontificaux, y compris les plus récents, ceux de Jean XXIII, de Paul VI et de Jean-Paul II. Il met une bibliothèque à disposition et procède à la diffusion du droit naturel et chrétien, organisant un congrès en automne à Lausanne. L'autre, I'Office international, en fait de même en France, édite la revue Permanences, organise un congrès en divers endroits aux alentours de Pâques.

Le CDC a toujours tenu publiquement le nazisme pour incompatible avec la doctrine sociale chrétienne. Ni Jean de Siebenthal, ni la revue Finalités, n'ont participé à l'organisation d'un office religieux au cours duquel la mémoire de Bastien-Thiry aurait été honorée. Jamais Finalités n'a prétendu organiser quelque guerre sainte que ce soit. Elle est pour la démocratie en tant qu'elle respecte les valeurs historiques de la Suisse. Il est contraire à tout œ que professe Finalités de prétendre que la démocratie, prise au sens de Pie XII dans son radio-message de 1944, usurpe les droits de Dieu.

Le CDC recommande effectivement l'organisation de cellules destinées à la réflexion et non à l'action collective. Il est opposé à la lutte des classes qui est totalement incompatible avec la doctrine sociale chrétienne.

12 Demande d’enquête sur les fraudes électorales

J’ai signalé des fraudes électorales avérées et prouvées, mais la justice ne cherche pas la vérité dans ce domaine pourtant si important pour le bien public.

Nous avions alors déjà fait recours et ils ont détruit tous les bulletins de vote pourtant sous séquestre ( une preuve, ils avaient peur que nous ayons ainsi les preuves de notamment leurs empreintes digitales ), alors qu'il y avait péril en la demeure pour tricherie par tri sous spots lumineux, parce qu'ils savaient que nous pouvions prouver leurs tricheries. C'est un aveu honteux pour notre démocratie. Nous aurions pu le prouver par les empreintes digitales des tricheurs sur les bulletins détruits illégalement.

M. Bernard Mühl a fait un faux témoignage par écrit dans notre précédente procédure en affirmant que ces enveloppes jaunes ne sont pas transparentes, ce qui est un mensonge avéré et prouvé et un pur mépris de la réalité que chacun peut vérifier chez soi.

( voir la photographie ci-dessous )

![]()

Ces enveloppes jaunes sont à disposition pendant plusieurs jours ( 3 semaines ) dans les bureaux de chaque greffe. Vu les plus de 40'000 imprimées en plus, plus 15% de maculature...soit 101'000 enveloppes jaunes et bulletins de trop (en tout cas facturé aux contribuables à chaque votation depuis plus de 10 ans... quel gaspillage écologique et économique...) il y a assez de matériel en réserve pour changer simplement les enveloppes par d'autres plus "justes".....

Le Conseil d'État vaudois rejette deux recours déposés après l'approbation des passeports biométriques le 17 mai en votation. Le non tient, après leurs tricheries à l'échelle suisse, surtout sur les milliers de votes électroniques truqués par les polices fédérales secrètes et illégales Tigris et Tiago, à seulement 2'753 voix, soit la moitié de l'écart plus une voix...

Cette décision est grotesque. Il n'y a plus dans le canton de Vaud de secret de vote. En effet, vu la transparence des enveloppes jaunes sous simple spot lumineux à 20 watts et 12 volts (sic, merci Ikea), transparence jamais corrigée depuis des années malgré les promesses des autorités et notamment du Chancelier, le rapprochement nominatif est possible dans chaque greffe municipal pendant des semaines avec nos bulletins gris signés.

Nous avions alors déjà fait recours et ils ont détruit tous les bulletins de vote pourtant sous séquestre (une preuve, ils avaient peur que nous ayons ainsi les preuves de notamment leurs empreintes digitales), alors qu'il y avait péril en la demeure pour tricherie par tri sous spots lumineux, parce qu'ils savaient que nous pouvions prouver leurs tricheries. C'est un aveu honteux pour notre démocratie. Nous aurions pu le prouver par les empreintes digitales des tricheurs sur les bulletins détruits illégalement.

Matériel suffisant pour voir à travers les enveloppes suisses de vote par correspondance.

Lampe expressivo à moins de SFR 8.-, ampoule comprise

Ampoule halogène G4 12V 20W, sic 12 volts et vingt watts...

Il suffit de presser l'enveloppe contre la vitre chaude de la lampe et de voir par la transparence ainsi obtenue...la croix du non près du carré noir permettant de mieux viser les votes.

Ou avec une lampe de poche à LED…

Près de 101'000 enveloppes prêtes et imprimées pour bourrer les urnes, seulement dans le canton de Vaud !

En Suisse, aucun canton n'a accepté de recompter quelques votes, même par sondages, malgré près de 500 recours de citoyens inquiets dans tous les cantons...

Le nom des partis et des candidats est très visible par transparence sous halogène à 20 Watts

Un vrai sceau et à côté, un sceau trafiqué sans les inscriptions officielles.

http://desiebenthal.blogspot.com/2009/06/tricheries-democratiques-par.html

Réactions mitigées en cours : Extraits du Conseil fédéral...

La libéralisation du vote par correspondance en 1994 remonte à deux motions adoptées à l'unanimité (motions des députés Eva Segmüller, conseil national - BO 1987 N 993 s.; BO 1988 E 6 - et René Rhinow, conseil des Etats - BO 1988 E 940 s.; BO 1990 N 284). Ces motions constituaient une solution pour pallier le taux croissant d'abstention aux scrutins.

En ce qui concerne la problématique générale du risque d'irrégularités lors des votations et des élections, le Conseil fédéral a déclaré le 13 mai 2009 qu'il était prêt à accepter le postulat Rennwald 09.3174 (Votations et élections. Attention à la fraude) et à établir un rapport sur la question. (en suspens...).

Ce rapport présentera les différentes formes de participation au scrutin (par les urnes, par correspondance, par voie électronique) selon le risque de fraude. Il s'agit d'examiner la question de la sécurité en amont du scrutin par voie électronique, par les urnes ou par voie postale, de vérifier si les citoyens subissent des pressions et d'examiner l'effet de pressions éventuelles sur le bon fonctionnement de la démocratie. L'objectif global de ce rapport est devoir comment garantir le fonctionnement sans faille de notre démocratie.

13 Travaux scientifiques pour rétablir la vérité sur la démographie mondiale

La crise 2008 déjà annoncée en 1989 lors d'un grand congrès à Lausanne, notamment par les facteurs démographiques. Notre livre: " Europe: l'hiver démographique" en parlait déjà en 1989. (Edition l’Age d'homme, Lausanne et Paris ) Les courbes de population utilisées qui y étaient utilisées étaient celles de Jean Bourgeois Pichat.

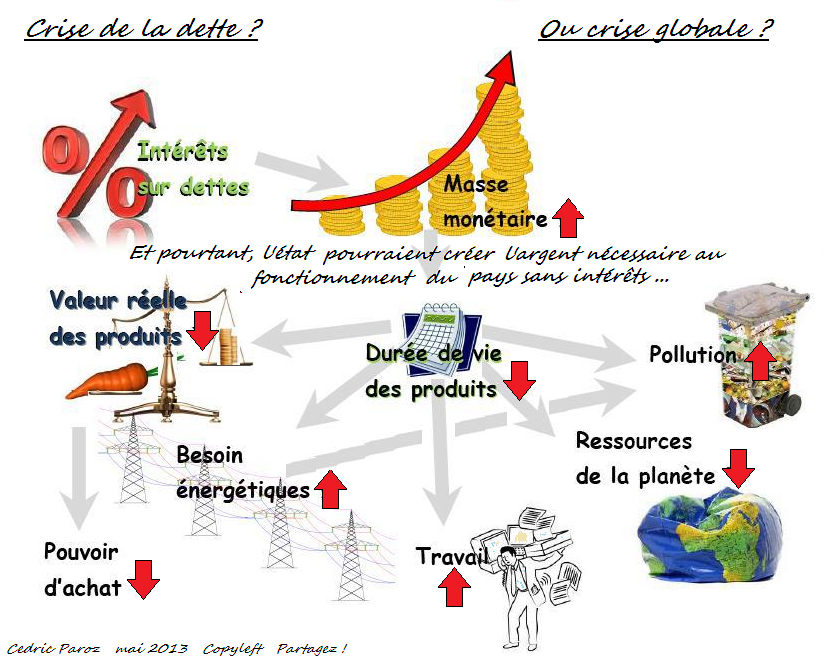

![]()

Ces graphiques mis en conclusion du livre démontraient que si aucune réaction sérieuse n'intervenait, nous aurions un maximum de population vers 8 milliards autour de 2040 puis l'effondrement d'une population vieillie retombant en 2100 bien en dessous du niveau actuel. En vérité nous devons faire face aux deux problèmes à la fois et, sur le plan écologique, aboutir à de vrais efforts en matière de respect de la nature, de lutte contre les gaspillages, d'éducation des populations.

La plupart des considérations démographiques biaisées ont été faites par les Nations Unies.

En effet, ces hypothèses sont fausses et ont été réfutées notamment par l'École française (Adolphe Landry, Alfred Sauvy, Jean Bourgeois Pichat, Philippe Bourcier de Carbon, Jean Claude Chesnais ) et en matière de démographie le danger le plus menaçant n'est pas l'explosion démographique - la natalité dégringole dans la plupart des pays du tiers-monde et déjà plus de vingt pays ont plus de décès que de naissances - c'est un vieillissement incontrôlé mettant des charges insupportables sur le dos des jeunes, d'où une baisse induite de natalité et un cercle vicieux aboutissant à l'effondrement notamment des prix de l'immobilier.

Dans les prochaines décennies, ce n'est pas la surpopulation mais la dépopulation qui menacera la planète, y compris l'Asie. Réunis à Tours, les démographes craignent de graves conséquences sociales et économiques. Nos analyses de Lausanne écrites en 1989 ont été confirmées, notamment en 2005: Exemples: Etienne Dubuis, Tours, Mercredi 20 juillet 2005, le Temps,

Les démographes annonçaient que la Terre aurait 15 milliards d'habitants en 2050, ils n'en prévoient plus que 9 milliards.

Dans les années à venir, ce n'est plus la surpopulation, mais la dépopulation qui menacera la planète. Pointée pour la première fois par l'ONU en 2002, cette nouvelle bombe démographique inquiète toujours davantage les chercheurs en population.

![]()

Vous pouvez voir ci-dessus la page 240 du livre “Europe, l’hiver démographique”

Nous aurons donc un maximum de population vers 8 milliards autour de 2040 puis l'effondrement d'une population vieillie retombant en 2470 à seulement deux habitants. Cette courbe théorique montre quand même la gravité de la situation pour notre civilisation.

http://desiebenthal.blogspot.com/2008/10/le-grand-krach-2008-dj-annonc-par-crit.html

14 Demande de réforme du fonctionnement du système monétaire

« La création de monnaie de rien actuelle par le système bancaire est identique … à la création de monnaie par des faux monnayeurs. ...» Maurice Allais, Physicien et économiste, Prix Nobel d'économie en 1988 « La crise mondiale aujourd'hui » (Ed. Clément Juglar 1999).

Manifestement, il s'agit d'être tout d'abord bien d'accord sur le vocabulaire utilisé. Ici, je relève que ce sont les mots "création" et "monnaie" sur lesquels la plupart s’achoppent…

Création : Ici, je vais me référer tout simplement au Petit Robert. La création est "l'action de donner l'existence, de tirer du néant" ou "l'action de faire, d'organiser une chose qui n'existait pas encore". Donc, si on parle de création monétaire par les banques commerciales, il faudra que la masse monétaire soit après leur action plus importante qu'avant, pour qu'il y ait à proprement parler "création"-

Monnaie : Je me réfère ici à un point qui fait l'unanimité des manuels d'économie. La monnaie est un moyen de paiement qui possède trois fonctions : intermédiaire facilitant les échanges, étalon de mesure de la valeur, réserve de valeur. L'euro, le franc suisse ou le dollar sont considérées comme monnaies, car elles réunissent ces trois fonctions.

Maintenant, je peux aussi noter que la monnaie fiduciaire (créée par la banque centrale) ET la monnaie scripturale (créée par les banques commerciales - cf. la définition retenue de création ci-dessus) ont toutes deux les vertus énoncées dans la définition retenue de la monnaie. La monnaie scripturale qui se trouve sur mon compte en banque me permet d'effectuer des achats, me permet de mesurer la valeur des objets de ma convoitise et peut encore être conservée sur ce compte comme réserve de richesse. La monnaie scripturale EST donc de la monnaie, si je reconnais la définition habituelle de la monnaie.

Du coup, la distinction entre monnaie fiduciaire et monnaie scripturale n'a de sens que pour comprendre et maîtriser le processus de création monétaire. Au niveau de la vie économique, il n'y a pas de différence, la valeur d'un dollar scriptural est la même que la valeur d'un dollar fiduciaire.