![Louis Even Louis Even]()

Le réel - Le financier - La Constitution - Nos politiciens - Les "On-to-Ottawa" - Douglas

Commissions scolaires et municipalités

A Alma (Lac St-Jean), 7,000 écoliers ont eu des vacances inusitées en février, parce que leurs 260 instituteurs et institutrices ont déclaré un arrêt de travail (on a dit "une grève").

La raison : ces enseignants n'avaient eu aucune paye depuis huit semaines. Vivre sur ses épargnes pendant huit semaines, c'est pour plusieurs vivre en s'endettant chez le marchand. Et le marchand lui-même ne peut pas indéfiniment faire crédit à des clients : il a des obligations, lui aussi.

Mais pourquoi la Commission d'Alma ne payait-elle pas ses professeurs ? — Simplement parce que sa caisse était vide. Elle avait un déficit de $500,000, qui allait devenir un déficit de $750,000 cette année.

La banque ne voulait plus faire d'avance à une commission en telle situation.

La commission scolaire d'Alma se tournait vers Québec. A Québec, on répondait : Vous avez déjà eu toutes les subventions auxquelles vous aviez droit, aux termes de nos règlements; trouvez plus d'argent chez vos contribuables; augmentez le taux de la taxe scolaire.

La commission scolaire a fini par céder. Sans demander aux propriétaires si ça leur faisait bien plaisir, elle a porté la taxe scolaire à $1.35 dans le 100 dollars d'évaluation.

Tout de suite, démarches du gouvernement auprès de la banque pour que le crédit soit restauré (le gouvernement devenant caution). Avec une avance de la banque, chèques aux professeurs. Fin des "vacances de grève"; retour à l'école le vendredi, 22 février.

Le cas d'une caisse vide en face d'obligations pressantes n'est pas l'exclusivité de la commission scolaire d'Alma. La plupart des commissions scolaires, et des municipalités aussi, tirent la langue. D'autres corps publics également. Ét les familles aussi, même si et-h, n'attirent pas autant l'attention que les corps publics, tout en souffrant plus qu'eux, dans leur chair même.

Le gouvernement provincial est au courant de la situation désespérée des commissions et des conseils municipaux. En 1960, le gouvernement Lesage nomma un comité interministériel pour étudier le problème — et le problème est toujours là. Le Comité est maintenant remplacé par une "Commission d'enquête sur la fiscalité" ! Pour faire quoi ? Pour tâcher de découvrir des moyens plus efficaces, si possible, de financer les gouvernements en dévalisant les individus.

Le possible — L'obstacle

Mais de quel problème au juste est-il question ? Et pourquoi ce problème existe-t-il ?

Revenons au cas d'Alma. Dès que la Commission se soumet au gouvernement en acceptant de hausser la taxe scolaire, la banque accepte d'avancer des fonds — un crédit — à la Commission. Et tout de suite, tout se règle. Plus de problème. Les professeurs sont payés et peuvent se procurer de quoi vivre.

C'est donc qu'il y avait dans le pays tout ce qu'il faut pour faire vivre les professeurs. La hausse de la taxe foncière n'a pas augmenté d'une seule unité les troupeaux des cultivateurs, ni fait pousser, un fruit de plus, ni produit une verge d'étoffe de plus. Tout cela existait bel et bien et n'attendait qu'un "crédit"— des chiffres inscrits du bon côté dans les livres de la banque, pour passer les produits des fermes, ou des entrepôts, ou des étagères du marchand, dans les maisons des professeurs.

Le problème n'était donc pas du tout un problème de possibilités réelles. C'était un problème créé artificiellement par le manque de chiffres ayant le pouvoir de faire bouger les produits et les services.

Voici bientôt un demi-siècle que l'artificiel de ce problème est étalé devant le monde —plus d'un quart de siècle dans notre pays; et, en même temps, le moyen de faire disparaître cet artificiel malsain, le moyen d'enlever l'obstacle purement financier aux belles réalisations si facilement possibles.

C'est l'enseignement du Crédit Social. Nous ne parlons pas ici du parti qui porte le nom de Crédit Social et qui peut être n'importe quelle bouillie. Nous parlons de l'enseignement de Douglas, le fondateur de l'école créditiste.

Quand l'école créditiste traite de crédit, elle fait une distinction entre ce qu'elle appelle le "crédit réel" et ce qui est le "crédit financier" ou l'argent.

Le "crédit réel", c'est la capacité de produire ce qui répond aux besoins. C'est la capacité de produire de la nourriture, des vêtements. C'est la capacité de bâtir des maisons pour les familles, des écoles pour recevoir les enfants, des églises pour assembler les fidèles, des routes des chemins de fer, pour les voyages et le transport, etc. C'est la capacité de trouver des professeurs pour instruire les écoliers. Et c'est la capacité de produire les choses que les professeurs consomment, mais qu'ils ne produisent pas eux-mêmes.

Il s'agit bien là de réalités. De réalités dont l'existence ne fait pas de doute. Des réalités qui font qu'on préfère le Canada à un désert, qui font qu'on a confiance de pouvoir vivre convenablement au Canada. Cette base de confiance existait déjà quand les premiers colons vinrent de France. Ils ne seraient pas venus sans cela. Et cette base de confiance, cette capacité de produire ce qu'il faut pour les besoins, ce "crédit réel" est immensément plus grand aujourd'hui.

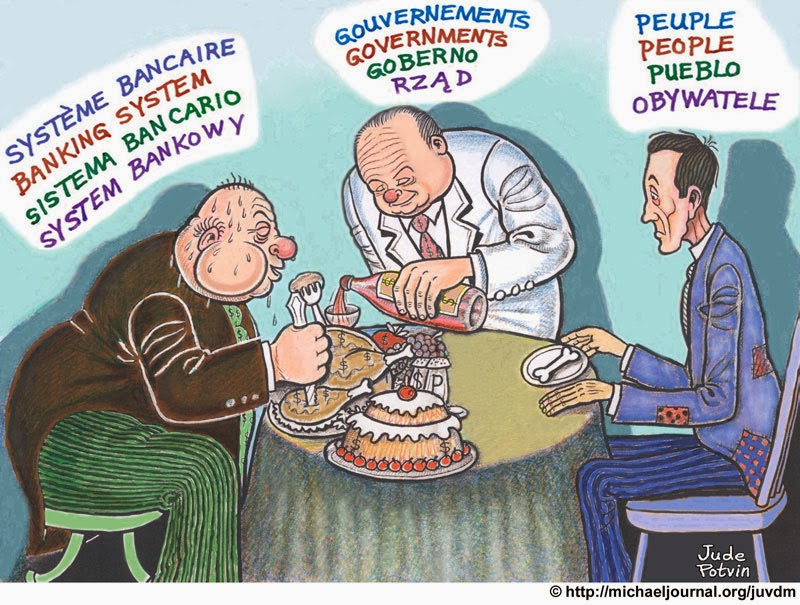

Par contre, il y a le "crédit financier", qui sert d'argent. Qui consiste essentiellement en chiffres légalisés. Qui peut être des chiffres gravés sur des pièces d'or (on n'en voit plus), des pièces d'argent, ou de cuivre, ou de bronze, ou de nickel, ou quoi encore. Ou des chiffres simplement imprimés, accompagnés de figurines et de quelques phrases, sur des rectangles de papier. Ou simplement, et pour la plus grande par tie, des chiffres inscrits par les banquiers dans leurs livres, quand ils font des prêts à des-emprunteurs, emprunteurs privés ou corps publics.

Ces chiffres, le "crédit financier", ne sont pas des réalités. C'est simplement l'évaluation, en chiffres, de réalités qui existent déjà; ou de production facile à réaliser quand ces chiffres viennent à point pour tirer sur la capacité de production du pays.

Dans le cas d'Alma, comme dans la multitude d'autres cas semblables, le "crédit réel" n'a jamais fait défaut une minute. Mais ce qui faisait défaut, c'était l'artificiel, les chiffres pour exprimer le "crédit réel" et pour mettre en oeuvre la capacité de produire, la capacité d'enseigner et la capacité de faire vivre les enseignants.

Mais, n'est-ce pas une situation lamentable, que celle qui permet aux contrôleurs du crédit -financier de mettre ainsi une entrave à la fonction du réel, à la-production de -biens -(produits ou services) qui répondent aux besoins de la population — enfants et adultes ?

Le crédit provincial

La capacité de production du Canada est le crédit réel du Canada. Et la capacité de production d'une province est le crédit réel de cette province.

Une province, n'importe quelle province du Canada, est capable de produire des choses pour les besoins de sa population, même si toutes les autres provinces cessaient d'exister. Nos ancêtres le faisaient déjà, avec des moyens beaucoup plus limités, sur les rives du Saint-Laurent, bien avant que le reste du Canada fût même entamé par la hache et la charrue.

Il y a donc telle chose qu'un crédit provincial : Crédit Québec, Crédit Ontario, Crédit Nouveau-Brunswick, Crédit Manitoba, Crédit Alberta, etc.

Et s'il y a un crédit provincial, il doit bien être possible de l'évaluer provincialement, puisqu'il y a dans chaque province un gouvernement pour voir à l'ordre, à l'étendue de la province. Il doit bien être possible de représenter ce crédit réel en chiffres financiers; en chiffres aptes à mettre en œuvre le crédit réel, aptes à mobiliser les ressources matérielles et les compétences humaines de la province, pour répondre aux besoins de sa population.

Le crédit financier, en effet, ne sert pas seulement d'évaluateur; il sert aussi de moyens de paiements, pour récompenser ceux qui mettent en œuvre la capacité de produire; de moyens de paiement permettant à ceux qui les reçoivent d'obtenir les produits ou services offerts à la population.

Un crédit réel provincial; du crédit financier provincial correspondant; des moyens financiers surgissant du crédit réel provincial, capables de véhiculer par toute la province les produits et services émanant de la production de la province ou reçus d'ailleurs en échange de surplus provinciaux ... voilà qui fait dresser bien des oreilles; voilà qui fait des bouches d'ahuris crier le grand mot "Constitution".

Constitution et crédit

Eh bien, venons-y à cette "Constitution". Constitution dont on parle de plus en plus avec de moins en moins de respect. Constitution, ou du moins ce qu'on appelle de ce nom au Canada, qui n'est après tout qu'une simple loi du parlement de Londres, qu'on n'a même pas pris la peine de soumettre à l'approbation des provinces ou territoires coloniaux auxquels on l'a imposée.

Eh bien, si vieillotte soit cette "constitution", si prostituée ait-elle été par ceux qui l'ont constamment interprétée pour tirer à eux la couverte, elle a tout de même su au moins reconnaître l'existence d'un crédit provincial.

Elle spécifie, en effet, que la province a le droit d'emprunter "sur le seul crédit" de la province. Le fédéral, lui, peut le faire sur le crédit de tout le Canada; mais la province sur le sien propre. C'est donc que la province possède un crédit à elle. Le Québec a droit sur son crédit, pas sur celui de l'Ontario; et vice versa. Et de même pour les autres provinces.

Mais, si la province possède un crédit, qui lui permet ainsi d'emprunter et de s'endetter —pourquoi, en toute logique, ne peut-elle pas prendre _moyen d'utiliser ce crédit sans avoir à s'endetter pour l'usage d'une chose qui lui appartient ?

Si j'ai un cheval à moi, il me permet d'emprunter sur sa valeur; mais qu'est-ce qui m'empêche d'utiliser moi-même mon cheval, quand tel est mon bon plaisir, sans avoir à m'endetter envers personne ?

Et n'est-il pas assez bizarre d'aller quémander des chiffres belges, français, anglais, américains, etc., pour mettre en œuvre le travail et les ressources naturelles du Québec, ou de l'Ontario, ou du Nouveau-Brunswick, etc. ? Pourquoi, par un simple jeu de chiffres, pourquoi avoir à payer à d'autres de la production faite par des bras de chez nous, à partir de matériaux de chez nous ?

Nos politiciens

M. Lesage étatise l'électricité, en disant que c'est pour que nous devenions maîtres chez nous. L'électricité, si importante soit-elle, ne touche tout de même qu'à une partie de notre vie économique — alors que le contrôle de l'argent, alors que le système financier touche à toute la vie économique, en gros et en détail, dans le général et dans le quotidien, dans le secteur public et dans le secteur privé. Or M. Lesage ne s'en inquiète pas !

D'ailleurs, pour acheter les réseaux des compagnies, M. Lesage commence par endetter la province de. 300 millions, qui exigeront bien des millions de plus avec les intérêts. Nous avions à payer le courant électrique aux compagnies : nous aurons maintenant à le payer au gouvernement, et à payer les compagnies en plus.

Par cet emprunt, fait sur le marché américain, M. Lesage endette sa province envers : First Boston Corporation; A. E. Ames & Co., Incorporated; Wood, Gundy & Co., Inc.; The Dominion Securities Corporation; Harriman Ripley & Co.; Smith, Barney & C.; McLeod, Young, Weir, Incorporated. -- Drôle de manière, vraiment, de rendre la population de l'État de Québec maîtresse chez elle !

Mais revenons au crédit financier. Et à la Constitution.

M. Johnson, le chef de l'Opposition, demande de convoquer des Etats-Généraux pour rédiger une nouvelle constitution. Avec quoi en vue ? La question de fiscalité, de taxation seulement ? Ou bien avec l'objectif de restituer au peuple ce qui lui appartient — son crédit ? Au peuple de l'État de Québec, le crédit du Québec. Comme au peuple de chaque province, le crédit de sa province.

Si l'on est contre la centralisation des pouvoirs à Ottawa, et par Ottawa au cerveau financier international, que l'on commence donc par se soustraire à l'instrument primordial de la centralisation : ce contrôle du crédit qui force à se plier à toutes les volontés des contrôleurs (privés) de l'argent et du crédit.

Même nos séparatistes, avec toutes leurs déclarations d'indépendance, ne semblent pas avoir conscience de la dépendance dans laquelle nous maintient le contrôle actuel du crédit financier. Il est bien plus urgent de se séparer de la dictature internationale de l'argent que de se séparer des autres provinces du Canada. Que devient l'indépendance, politique, quand la vie économique de tous les jours est sous la complète dépendance d'individus non élus qui, d'ailleurs, prennent leur inspiration et leurs directives de non-élus internationaux ?

Montréal-Matin du 18 février rapportait la déclaration suivante; faite à l'hôtel Queens par le chef séparatiste, Marcel Chaput "Nous croyons au crédit comme force de développement économique". — Fort bien, mais avec cette force laissée aux mains des contrôleurs de l'argent et du crédit qui dominent les gouvernements comme les populations ? Au bénéfice de qui seront les développements économiques qui endettent la population à mesure qu'elle crée de la richesse ? Quelle sorte d'indépendance cela signifierait-il ?

Et le parti qui ose se donner le nom de Crédit Social — que fait-il, que cherche-t-il pour s'affranchir de la tyrannie du système financier actuel ? Ce n'est certainement pas à ses dirigeants qu'il faut demander la décentralisation financière, le Québec maître chez lui, l'Ontario maître chez lui, le Nouveau-Brunswick maître chez etc.

Non. Le mot d'ordre du parti est devenu "On to Ottawa". Pas seulement de la part, de la section albertaine du parti, mais de Caouette lui-même et de ses suiveux.

Douglas et le "On-to-Ottawa"

Rappelons d'abord que le premier chef des créditistes albertains, Aberhart, a toujours tenu pour le contrôle du crédit provincialement. De 1937 à 1939, son gouvernement fit adopter plusieurs lois provinciales dans ce but, remplaçant par d'autres celles qui se faisaient bloquer à Ottawa ou dans les cours de justice.

En 1939, à cause de la guerre, il jugea devoir suspendre cette lutte. Il mourut pendant la guerre: Son successeur Manning, sous la pression de créditistes lui représentant que la guerre finie, il fallait reprendre la lutte, fit un essai, par un Bill of Rights, pas bien authentiquement créditiste, voté en 1946, puis déclaré ultra vires jusque par le Conseil Privé.

En 1947, Manning capitula complètement, et le "On-to-Ottawa" naquit de cette capitulation. Cela voulait dire : "Aberhart avait tort et Ottawa a raison."

Un parti qui capitule devant Ottawa capitulerait encore bien plus facilement devant des puissances qui dominent Ottawa, comme elles dominent Washington et les autres gouvernements même considérés souverains.

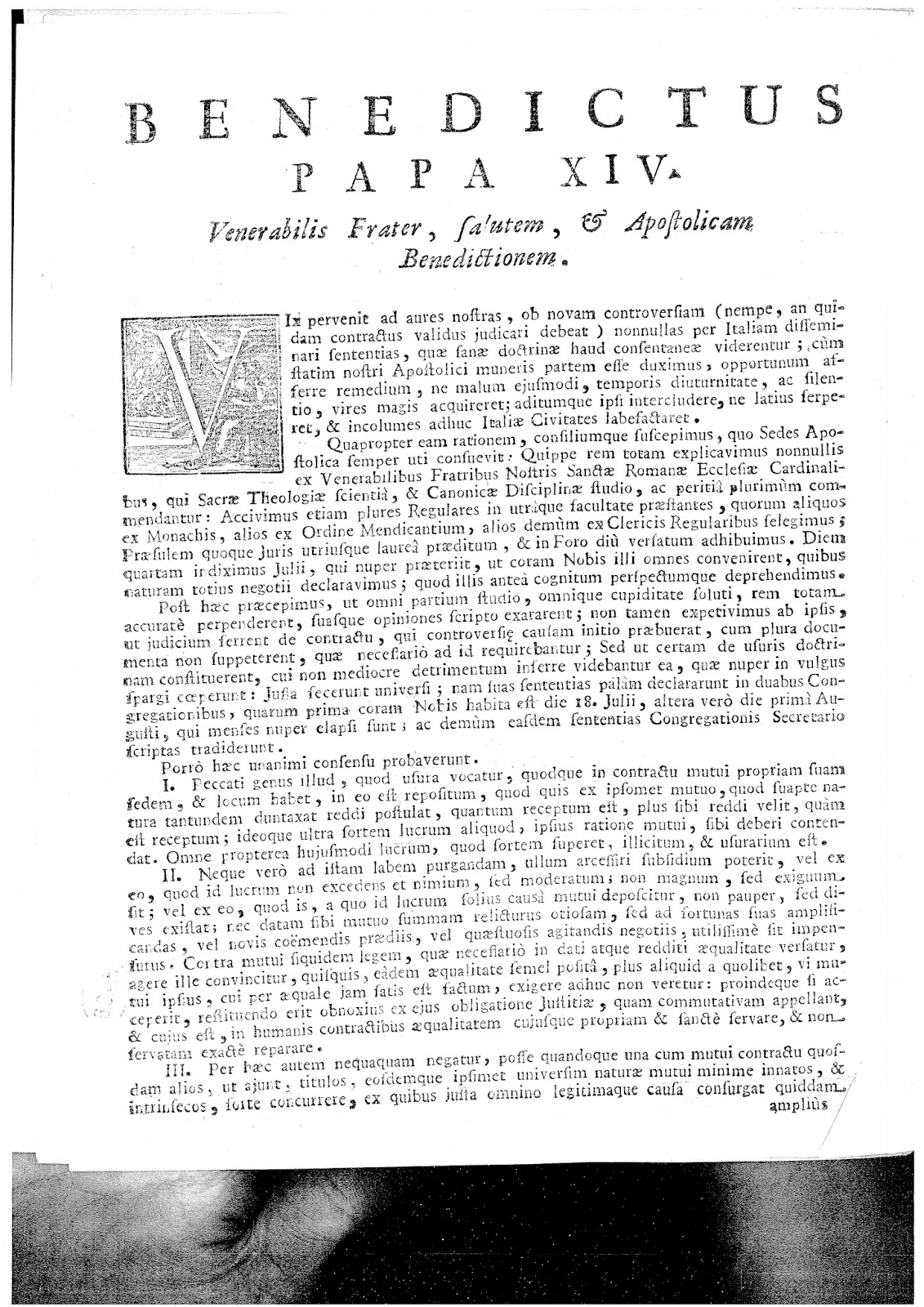

Mais que pensait le maître, Douglas, de ce "On-to-Ottawa" ?

Dès 1934, quand Aberhart faisait sa grande propagande pour le Crédit Social, quand les Fermiers-Unis étaient encore au pouvoir à Edmonton, la question fut posée à Douglas. Elle, le fut à l'enquête sur le crédit, que conduisait le -Comité Agricole de l'Assemblée Législative de l'Alberta.

Le gouvernement des Fermiers-Unis n'était pas opposé à la doctrine de Douglas, mais prétendait que la question ne pouvait relever que d'Ottawa. Aberhart, au contraire, soutenait que l'institution pouvait se faire provincialement.

Questionné sur ce point par MM. Ross et Gibbs, puis par M. MacLachlan, Douglas répondit d'abord aux deux premiers :

"Rendre la question toujours de plus en plus grosse; de plus en plus étendue, fait partie du grand plan des aviseurs du système financier. Ils le font, afin qu'on soit obligé de gagner un groupe toujours de plus en plus nombreux de personnes pour essayer de la régler.

"On tend ainsi à en faire une question mondiale, afin qu'il faille convoquer des conférences mondiales pour trouver des solutions. Or, tout le monde sait ce qu'il résulte des conférences mondiales.

"Il n'y a qu'une méthode efficace : Circonscrire de plus en plus le problème, le diminuer autant que possible, afin d'en arriver à une application quelque part."

Donc, au lieu d'attendre à avoir gagné à une idée tout le Canada, quand on a gagné une province, soit le territoire qui dépend de la plus petite unité de gouvernement doté d'un pouvoir législatif, commencer l'application là même, au lieu de grossir le problème.

Et à la question de MacLachlan, Douglas répondit encore plus longuement dans le même sens. Voici cette réponse :

"Dire : Il faut aller à Ottawa, revient à dire, en pratique sinon en paroles : Il faut s'adresser à Londres; vu qu'on a affaire avec la finance internationale, qu'on n'est pas capable de régler cela à Ottawa, il faut donc aller à Londres. Et à Londres, on vous dira : Fort bien, mais il faut agir de concert avec Wall Street (le New-York financier). Et là, on vous dira encore : Entendu, mais il- faut agir d'après la Banque des Règlements Internationaux (la banque. mondiale d'avant la deuxième guerre).

"Il n'y a absolument aucun point d'arrêt possible, une fois qu'on s'est laissé aller à renoncer, à son droit d'agir librement. C'est justement la stratégie des puissances, financières actuelles de faire de la question de finance une question mondiale, afin qu'aucune partie du inonde ne soit assez puissante pour la régler.

"Si vous voulez arriver à un résultat, le meilleur moyen est de commencer chez vous, en cherchant d'abord comment réussir provincialement. Si vous envisagez le problème dans cet esprit, vous pouvez le régler. Mais si vous référez le problème à Ottawa, vous ne pourrez certainement pas le régler.

"Si vous laissez volontiers une législation supérieure vous empêcher de faire ce. que vous voulez, vous ne pouvez sûrement réussir aucune réforme. En définitive, il vous faudra, oui ou non, dire : Peu importe l'Acte de l'Amérique Britannique du Nord; s'il nous nuit, nous le ferons MODIFIER; ou nous le CONTOURNERONS; mais nous réaliserons certainement ce que nous voulons."

Douglas ne mâchait pas ses paroles. Mais c'est que la réforme dont il était 'question est d'importance et il le savait. Aussi, comme pour justifier l'avis radical qu'il donnait, il souligna brièvement le mal que, selon lui, comme aussi selon nous, le système financier fait au monde par son contrôle arbitraire du sang de la vie économique des nations :

"A l'heure actuelle, pratiquement 90 pour cent des crimes, dans le monde entier, sont causés directement par le système financier.

"La poussée économique (parfaitement compréhensible) vers la guerre provient avant tout du fonctionnement du système financier actuel qui conduit infailliblement à une course aux marchés étrangers pour en obtenir du pouvoir d'achat.

"Toute la misère actuelle, tous les tracas des hommes d'affaires, les suicides dont le nombre ne cesse d'augmenter, la classe de parias issue de taudis ou d'autres lieux inhumains, tout cela provient directement du système financier actuel."

Après le tracé de ce tableau, le Major Douglas pouvait bien poser la question, à savoir s'il faut rester lié devant la "Constitution" qui prétend s'opposer à la volonté de toute une province pour s'affranchir d'un tel système :

"Peut-on réellement envisager tout cela et dire encore : Oh ! non, il ne faut pas toucher à l'Acte de l'Amérique Britannique du Nord ?

"Voilà le point de vue selon lequel vous devez envisager la situation. Autrement, vous ne faites tout simplement qu'accepter les conséquences logiques du système financier actuel.

"Il n'y a qu'une question à vous poser : Que pouvez-vous faire pour changer ce système financier ?

"S'il existe une loi écrite qui vous empêche de le changer, et si vous ne voulez pas violer la- loi. (c’est-à-dire si vous tenez à agir constitutionnellement), alors vous n'avez qu'une chose- à faire : changer la loi. Cela, à mon avis, ne peut se réaliser qu'au moyen d'une pression concertée de toute la population.

"Tout: le monde, sauf le financier, subit l'affreux fléau de ce système financier détraqué et destructeur. Je dis cela sans parti: pris. Je ne suis nullement une victime sérieuse, moi-même. Mais j'observe simplement la chose du point de vue d'un ingénieur."

Voilà comment parlait Douglas, le maître, le découvreur et l'énonciateur des principes du Crédit Social.

Ce n'est pas du Manning. Ce n'est pas du Bennett. Eux disent : Il ne peut être question de Crédit Social provincialement. Ce n'est pas du Thompson, le leader actuel du parti "Onto-Ottawa". Ce n'est pas du Caouette, qui proclame qu'il faut aller à Ottawa et ne pas perdre son temps à chercher des remèdes dans des mesures provinciales, que les provinces sont impotentes. Il' accepte le point de vue poussé par la haute finance.

Tous ces petits esprits osent se servir du nom de Douglas, parer leur parti du nom de sa doctrine, alors qu'ils piétinent tous les points de vue et toutes les déclarations de cet homme de génie.

Quand toute la population de l'Alberta pensait encore en termes de Crédit Social, le gouvernement Manning renonça définitivement — et le déclara ouvertement — à tout nouvel effort pour instituer une économie créditiste provinciale. Il rendit les armes. Le résultat, c'est qu'aujourd'hui, le Crédit Social doctrine n'est plus en Alberta que de l'histoire ancienne. Le peuple albertain ne pense plus provincialement qu'en termes de "bon gouvernement"; satisfait de l'administration de Manning, il le maintient au pouvoir. Et fédéralement, les Albertains, fermiers, pensent surtout en termes de vente de blé, fût-ce à la Chine ou à la Russie.

Mais de voir des gens qui parlent encore en termes de Crédit Social prétendre en obtenir la réalisation en prenant de la distance, en "élargissant le problème", c'est grand' pitié, vraiment.

Au juste, la lutte pour le droit de l'Alberta à l'utilisation directe de son propre crédit réel ne dura que deux années; mais elle eut au moins le mérite de montrer quelle puissance domine les gouvernements centraux. Tandis que l'On-to-Ottawa, lancé en 1947, n'a rien donné après 16 ans, sauf de démontrer la futilité de poursuivre une réforme de l'importance du Crédit Social par de simples luttes électorales, en soumettant une doctrine, après l'avoir passablement émondée, aux aléas de l'urne électorale. Le Major Douglas conseillait donc de choisir entre trois formules :

La première : Passer outre à une Constitution qui protège un système adversaire du bien commun et générateur de maux graves et innombrables. Mais cela demande un peuple prêt à suivre son gouvernement. En 1944, je posais moi-même un jour la question à Solon Low, alors encore trésorier provincial de l'Alberta : "Pourquoi Aberhart, et plus tard Manning, n'ont-ils pas passé outre aux objections d'Ottawa ou d'autres sources, en disant : C'est la volonté prépondérante du peuple albertain ?" Solon Low me répondit : "Le peuple n'aurait pas suivi". — "Et pourquoi donc n'aurait-il pas suivi, puisqu'il avait si majoritairement voté créditiste ?"— "Ah !" fut la simple réponse de M. Low.

Le vote, il est vrai — et nous le comprenons mieux encore aujourd'hui — ne signifie pas grand' chose : il est bien plus le fait d'une masse cuisinée que l'expression de la volonté déterminée d'un peuple éclairé. D'ailleurs, les Albertains l'ont démontré une fois de plus, lorsqu'ils ont fait plus confiance au système des banques, système qu'ils avaient dénoncé, qu'au système des Succursales du Trésor, établi par un gouvernement pour lequel ils avaient voté.

La deuxième manière exprimée par Douglas, c'est de "contourner" les termes d'une loi qui veut s'opposer à la liberté de s'affranchir provincialement d'entraves purement financières.

Ce contournement pourrait se faire par l'institution d'un système de comptabilité interne, pour les transactions internes relatives à la production et à la distribution. Système tenu par un organisme provincial, relevant du ministère provincial des Finances (Trésor provincial), avec fonction de conformer cette comptabilité aux faits économiques dé la production et de consommation dans la province, pourvoyant à des facilités pour les transactions avec l'extérieur. Un peu comme le système des Succursales du Trésor établi en Alberta par Aberhart en 1938. Mais, comme nous l'avons vu ci-dessus, cela exige un peuple à la fois renseigné, prêt à collaborer en tournant le dos au système bancaire actuel dans toute la mesure qui lui en est offerte.

La troisième manière, c'est de "faire modifier le texte de la loi servant de Constitution." Mais là encore, il faut un peuple prêt, à mettre tout son poids à obtenir cette modification. C'est encore Douglas qui le dit : "Cela, à mon avis, ne peut se réaliser qu'au moyen d'une pression Concertée de toute la population".

Une pression concertée de toute la population ne peut jamais être le fait d'un peuple divisé par des partis politiques. Encore moins quand l'un de ces "diviseurs" se donne l'étiquette Crédit Social, et qu'il cherche justement à éloigner les créditistes du maître Douglas et les invite à faire confiance à des poursuivants de pouvoirs, d'honneurs et d'argent.

* * *

Il y a là matière à réfléchir, pendant la présente compagne électorale, pour ceux qui disent vouloir le Crédit Social. Feront-ils confiance au maître, ou suivront-ils des politiciens ?

Il est vrai que les atmosphères d'élection ne sont guère propices au resplendissement de la vérité. Mais notre devoir est tout de même de faire écho à la pensée du fondateur du Crédit Social, même au milieu de tout le tapage provoqué par ceux qui le trahissent. Il reste, après tout, des gens qui savent' tête garder, et c'est bien parmi les lecteurs réguliers de Vers Demain qu'on doit surtout pouvoir les trouver.

Ce n'est pas un "nouveau parti", mais un "peuple nouveau", un peuple de citoyens renseignés, formés à la responsabilité personnelle, qui fera instituer l'économie nouvelle, l'économie du Crédit Social telle que conçue par le maître Douglas.